The equity has a history of big post-earnings reactions

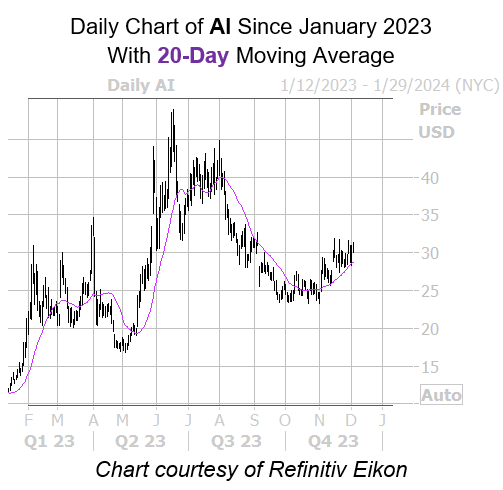

Artificial intelligence (AI) hotshot C3.ai (NYSE:AI) will announce fiscal second-quarter earnings after the close on Wednesday, Dec. 6. The security is up 170% so far in 2023, but has recently run into resistance at the $32 region. The 20-day moving average has served as a floor for shares since early November, however, containing several of their pullbacks. At last check, AI is down 2.2% at $30.22.

The stock has a tumultuous history of post-earnings reactions. C3.ai stock finished five of its past eight next-day sessions lower, including 12.2% and 13.2% drops after its last two reports, but also saw a 33.6% pop in March. The shares averaged a move of 13.2% in the past two years, regardless of direction, but the options pits are pricing in a much larger-than-usual swing of 20.1% this time.

A positive post-earnings reaction this week could trigger a short squeeze. Short interest is already down 7.5% in the last two reporting periods, and the 35.11 million shares sold short make up a whopping 34.9% of the stock’s available float. It would take shorts one week to buy back their bets, at AI’s average pace of daily trading.

Image and article originally from www.schaeffersresearch.com. Read the original article here.