The software stock yesterday hit a two-year high of $638.25

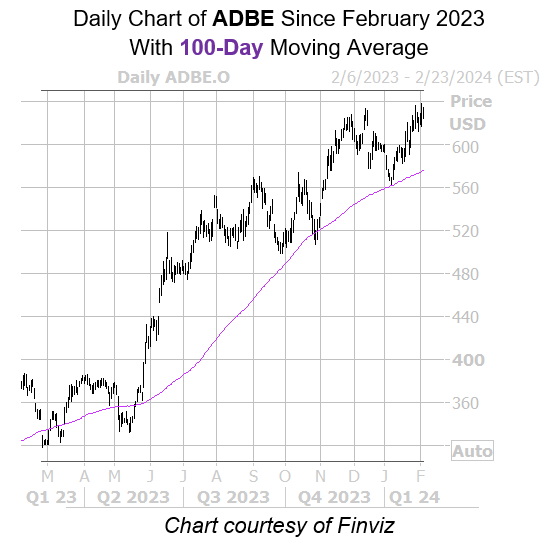

Adobe Inc (NASDAQ:ADBE) stock is down 1.1% at $628.06 at last check, but in the previous session hit a two-year high of $638.25, after long-time support at its 100-day moving average contained its January pullback to the $566 region. ADBE could soon extend its 65.4% nine-month lead, too, if past is precedent.

The stock is sporting historically low implied volatility (IV), which coincides with the security’s recent highs to make up a bullish combination. Per Schaeffer’s Quantitative Analyst Rocky White, there were seven other signals during the last five years when ADBE was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) stood in the 20th percentile of its annual range or lower.

This is the case with the stock’s current SVI of 27%, which stands in the 18th percentile of annual readings. Per White’s data, the shares were higher one month later 86% of the time after the signal, averaging a 4.7% rise. From its current perch, a similar move would place the stock above $657 for the first time since December 2021.

While the options pits are already mostly bullish on ADBE, some firms remain on the sidelines. In fact, six of the 27 brokerages in question still sport a tepid “hold” or worse rating. Should any of these analysts become more optimistic, Adobe stock could surge even higher.

Image and article originally from www.schaeffersresearch.com. Read the original article here.