FTNT is surging on a quarterly profit win and upbeat outlook

Fortinet Inc (NASDAQ:FTNT) is surging, last seen up 10.6% to trade at $59.53, after the company reported better-than-expected fourth-quarter profits of 44 cents per share. While revenue came in slightly below estimates, the cybersecurity name also issued an upbeat current-quarter and fiscal year revenue forecast.

At least 16 analysts have raised their price targets in response, including Wells Fargo to $72 from $62. It wasn’t all bull notes, though, with Keybanc downgrading the security to “sector weight” from “overweight.” Coming into today, 20 of the 29 analysts in coverage called FTNT a “buy” or better, while the 12-month consensus target price of $68.44 is a 14.9% premium to current levels.

As it turns out, Fortinet stock is among the best S&P 500 Index (SPX) stocks to own this month. According to Schaeffer’s Senior Quantitative Analyst Rocky White last study, FTNT averaged a return of 8.1% in February in the last 10 years, and finished the month higher nine times. That makes it the second best stock on the list, behind only Enphase Energy (ENPH).

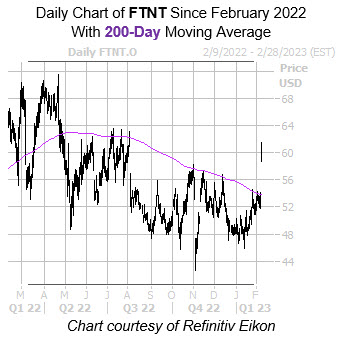

Shares are today trading at their highest level since August, as they are fresh from a bounce off the $52 region and have broken above overhead pressure from the 200-day moving average. So far in 2023, FTNT has added 22.2%.

Options traders are not sleeping on today’s bull gap, with 20,000 calls and 6,028 puts across the tape so far, which is seven times the volume that’s typically seen at this point. Most popular is the February 60 call, followed by the 65 call in the same monthly series, with positions being opened at both.

Image and article originally from www.schaeffersresearch.com. Read the original article here.