Carvana has adopted a shareholder rights plan

Carvana Co (NYSE:CVNA) adopted a shareholder rights plan, or a “poison pill,” to protect its ability to reduce future tax bills. Plus, Ally Bank and Ally Financial Inc have agreed to buy $4 billion in auto loans from the used car platform. Carvana stock is surging after the news, up 5.5% at $7.40, and earlier hit $8.21.

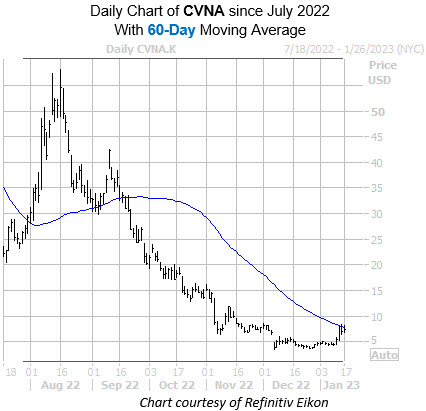

On the charts, CVNA is further removing itself from penny stock territory, where it sat from early December until last week. Year-to-date, the equity is already up 56.3%, though its 60-day moving average is still providing pressure. It’s also worth noting that the shares are on the short sell restricted (SSR) list today, amid the volatility.

So far today, 81,000 calls have crossed the tape — double the intraday average — in comparison to 25,000 puts. The January 10 call is the most active contract, followed by the April 7.50 call.

It’s also worth noting that short interest represents 56.6% of the stock’s available float. It would take nearly three days to buy back these bearish bets, at CVNA’s average pace of trading.

Options look like a good way to go when betting on Carvana stock, too, per its Schaeffer’s Volatility Scorecard (SVS), which sits at 100. This this means the security always exceeded option traders’ volatility expectations during the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.