The energy sector shined brightest in 2022, and could be set to soar again in 2023

Subscribers to Chart of the Week received this commentary on Sunday, January 1.

The stock market just wrapped up its worst year since 2008. In the last calendar year, there was a lot of time spent in this space unpacking the comeuppance of growth stocks, the tech correction, and the general malaise surrounding the stock market. Tesla Inc (NASDAQ:TSLA), tech, and the flavor of the week may have gotten most of the headlines, but in the last 12 months, the energy sector quietly chugged along, roaring past the S&P 500 Index (SPX) in 2022. In the spirit of New Year and reflection, let’s look back on the energy sector’s big year and see what could be in store for 2023.

Energy stocks outperformed the rest of the S&P 500 this year.

H/t to @chigrl who saw this coming way in advance. pic.twitter.com/CxYtYqQBih

— Markets & Mayhem (@Mayhem4Markets) December 29, 2022

The tweet above shows just how monumental the share price growth was for energy in 2022. The global eruption of commodity prices was triggered by Russia’s invasion in Ukraine that began in February and dragged on through the year. Sprinkle in the inflation spikes and it was a goldilocks environment for oil companies — Chevron Corporation’s (NYSE:CVX) roughly 52% gain paced the Dow, while Occidental Petroleum Corporation (NYSE:OXY) took home gains of about 116%.

Look down the list of oil stocks and you’ll see healthy gains throughout, even beyond the household names. One example is Vertex Energy Inc (NASDAQ:VTNR), a Schaeffer’s Top Stock Pick of 2022. The equity was attractive in December 2021 because of the company’s acquisition of the Mobile refinery from Shell PLC (SHEL). Vertex was also transitioning into waste oil refining, which offered much higher margins than traditional refining operations. There was enticing short squeeze potential 12 months ago, too, with 20% of the stock’s total available float sold short. VTNR is now up more than 34% year-to-date and traded as high as $18.10 in June.

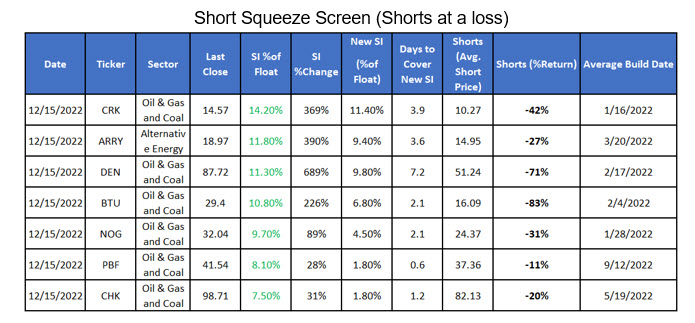

As the calendar turns to 2023, what’s the outlook for these darlings of 2022? There’s a natural gas crisis in Europe to monitor, but many investors remain bearish on the energy sector. On Wednesday, Senior Quantitative Analyst Rocky White compiled a list of stocks where short sellers were at a loss. Six oil names – and one alternative energy company, to broaden the energy bucket — stood out for their high short interest to float percentage, per the table below.

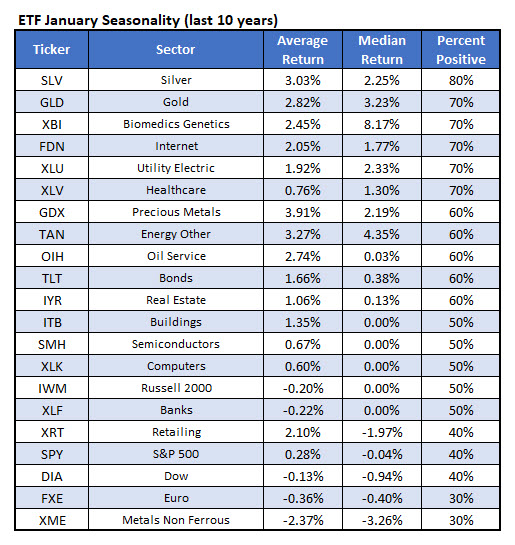

White also compiled a list of the best-performing exchange-traded funds (ETFs) in the last 10 years during January. The VanEck Vectors Oil Services ETF (OIH) averages a January return of 2.7% with 60% of the returns positive, a tally that’s fifth best of the 25 ETFs tracked. Also note that alternative energy ETF Invesco Solar ETF (TAN) is an intriguing name to watch, with an average January return of 3.3%.

Of course, the last thing to monitor heading into 2023 with energy stocks is the price of crude. West Texas Intermediate hasn’t settled above $100 per barrel since June and is back at levels from before Vladimir Putin lost his damn mind. yet black gold is still on track for an annual gain, and could be ready to rumble higher again, with three macro factors to be considered.

First, releases from the U.S. Strategic Petroleum Reserve— done by the Biden administration earlier this year – addressed supply disruption, but what impact will the eventual repurchasing mean? Secondly, China’s economy will slowly be reopened, reinserting a major economic player to the equation. What does their economic status bring to the table in regard to crude? And finally, what does a potential resolution to the Russia-Ukraine conflict, or sanctions stemming from its continuity, mean for crude prices?

If these developments mean more clean balance sheets for oil companies, then 2022 could just be the jumping off point for many stocks in the sector, one that as noted above, still has plenty of bearish detractors. That could mean a green light for contrarian traders looking to start 2023 on the right foot.

Image and article originally from www.schaeffersresearch.com. Read the original article here.