Under-the-radar tech stock Paycom Software (PAYC) tends to outperform in August

Subscribers to Chart of the Week received this commentary on Sunday, July 23.

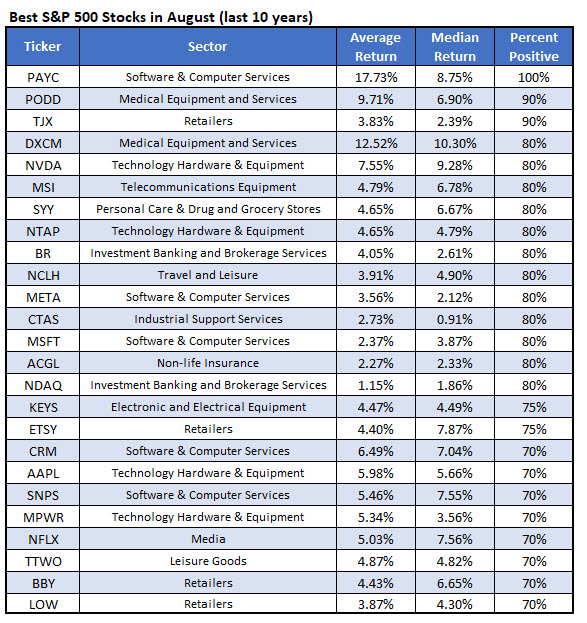

Today we’ll be diving into one of our favorite traditions at Schaeffer’s. If you’ve spent longer than 10 minutes on our site, you’ve probably combed through Schaeffer’s Senior Quantitative Analyst Rocky White’s list of the 25 best S&P 500 Index (SPX) stocks to own during a given month. This data –usually pulled ahead of the next month — is gathered from a decade of returns, separated by average and median return, and zeros in on historical monthly performance. Today we’re going to offer a sneak preview of the 25 best performers, and next week we’ll be zoning in on the 25 worst stocks to own for the upcoming month.

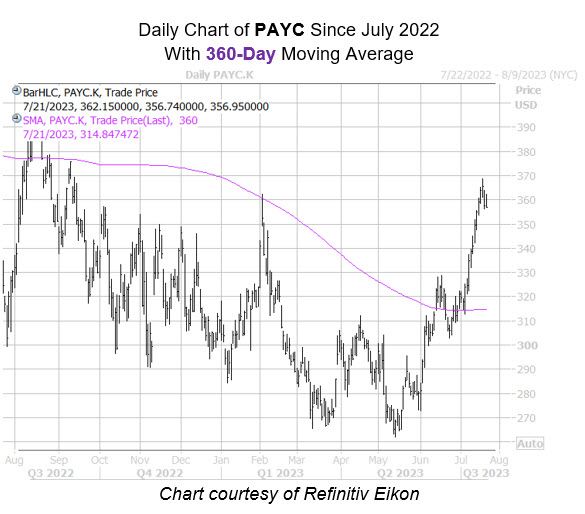

At the top of August’s list is Oklahoma-based Paycom Software Inc (NYSE:PAYC). The technology firm is fresh off 10 days of consecutive wins, enjoying its time back above the long-term resistant, 360-day moving average. This trendline capped a breakout attempt in early February but shifted into a floor of support earlier this month. Currently the shares are enjoying a 15% year-to-date gain, but remain a distance from the August 2022, $402.78 peak.

Now is looking like a prime entry point for bulls, however, with the security cooling from its aforementioned win streak. Plus, per White’s data, PAYC has finished higher every time for the month of August in the past 10 years. The stock has churned out an average one-month return of 17.7% for August, meaning a move of this magnitude from PAYC’s current perch of $358.02 would put the equity above $421 — a more than two-year peak.

Another catalyst for bulls is options are looking affordable for Paycom Software stock. These attractively priced premiums are evident per its Schaeffer’s Volatility Index (SVI) of 38%, which sits in the low 28th percentile of its annual range.

If you aren’t looking to add from the tech sector, there are some other great options for your August portfolio. The list includes medical device giant DexCom Inc (NASDAQ:DXCM), which sports the highest median return on the list and has finished August higher in eight out of the last 10 years, as well as retailer TJX Companies Inc (NYSE:TJX), which averages a 3.8% August return and has ended higher 90% of the time.

Image and article originally from www.schaeffersresearch.com. Read the original article here.