Plus, 25 of the best SPX stocks to target this month

Subscribers to Chart of the Week received this commentary on Sunday, October 1.

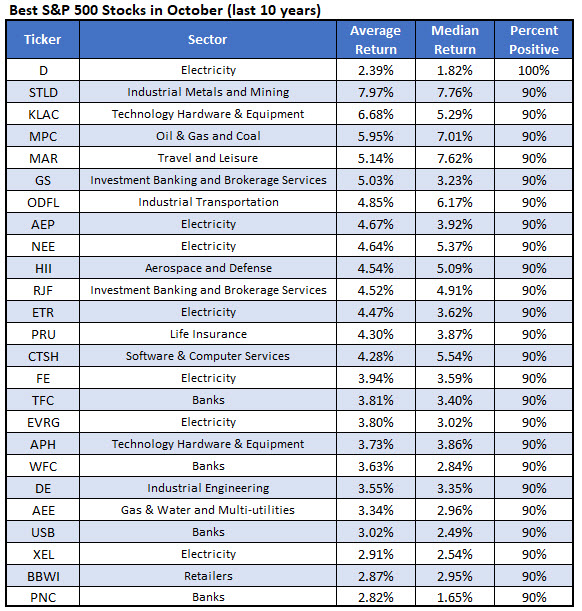

October is finally here, mercifully closing the book on a brutal month for investors. In the spirit of fresh starts, we’re putting September in the rear view mirror and unpacking a fresh list of historical October outperformers from Senior Quantitative Analyst Rocky White. October’s list features an unsuspecting sector filling seven of the top 25 S&P 500 Index (SPX) best-performing stocks over the past 10 years. We will also be taking a look at the runner-up entering a pivotal period of the year.

Marking the top spot on White’s chart, and also the most popular sector is electricity stock Dominion Energy Inc (NYSE:D), which boasts a perfect record for the month of October in the last 10 years. The stock has churned out an average one-month return of 2.4% for October. As for the remainder of the utility sector, October looks promising. The names slated for wins, if history is any indicator, include American Electric Power Inc (NASDAQ:AEP), NextEra Energy Inc (NYSE:NEE), Entergy Corp (NYSE:ETR), FirstEnergy Corp (NYSE:FE), and more. Often unheard of on White’s “Best 25,” all remaining electricity names enjoyed an average return that moved positive in nine out of the last 10 Octobers.

The second-most popular sector on White’s list is banking. Blue-chip finance giant Goldman Sachs Group Inc (NYSE:GS) stands out, with an average October return of 5% in the last 10 years – ending the month positive nine out of 10 times. A similar October outperformance would help GS reclaim its year-to-date breakeven level. There’s technical support in place as well at $320, which held the latest three pullbacks over the summer.

The finance sector also features fall outperformers Truist Financial Corp (NYSE:TFC), Wells Fargo & Co (NYSE:WFC), US Bancorp (NYSE:USB), and PNC Financial Services Group (NYSE:PNC). Many of these names will also report earnings in October, adding an ounce of intrigue (and volatility) into the equation. With 90% win rates across the board, one thing is abundantly clear: October trading has the potential to remove the bitter taste September has left in investors’ mouths.

Image and article originally from www.schaeffersresearch.com. Read the original article here.