Taking a close look at Big-Cap stocks MCD and NKE

Subscribers to Chart of the Week received this commentary on Sunday, February 5.

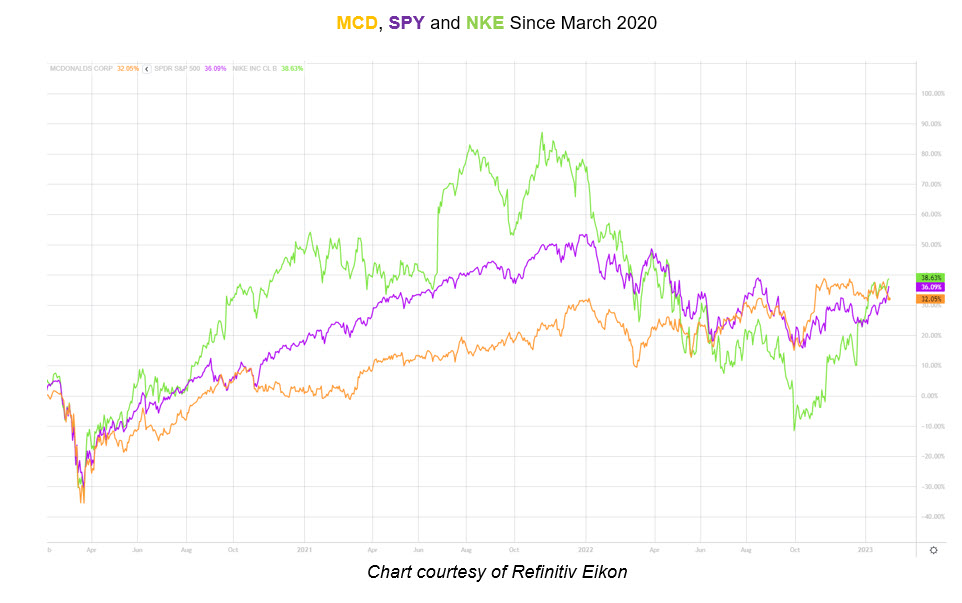

The broader SPDR S&P 500 ETF Trust (SPY) is an effective gauge as to how any respective stock is performing. This week, we are taking a closer look at two long-term Wall Street outperformers, one of which just stepped out of the earnings confessional. Why are these popular equities catching our eye now of all times, and why should options traders care? Their recent price performance has the stocks at some psychologically significant chart levels.

McDonald’s Corp (NYSE:MCD) reported fourth quarter adjusted earnings of $2.59 per share on revenue of $5.93 billion, to go with a 12.6% rise in same-store sales — all of which beat analyst estimates. Instead of a large bull gap higher on the charts though, MCD only added a modest gain, likely weighed down by comments from CEO Chris Kempczinski, who warned “short-term inflationary pressures to continue in 2023.” As of this writing, the equity remains above its year-over-year breakeven level.

Nike Inc (NYSE:NKE) doesn’t report its next quarterly earnings until March but isn’t even a month removed from its late-December fiscal second-quarter blowout. Although the company shared its best quarter for revenue growth in over 10 years, Nike stock fell nearly 3% for its post-earnings session. Longer term, NKE is enjoying a 42% three-month gain.

Per the chart above curated by Schaeffer’s Senior Market Strategist Chris Prybal, both stocks boast roughly the same return as the SPY in the last three Covid-filled years. Their paths are slightly divergent though; NKE initially outperformed but then shifted to an underperformance during this time frame. MCD has mirrored the SPY more closely.

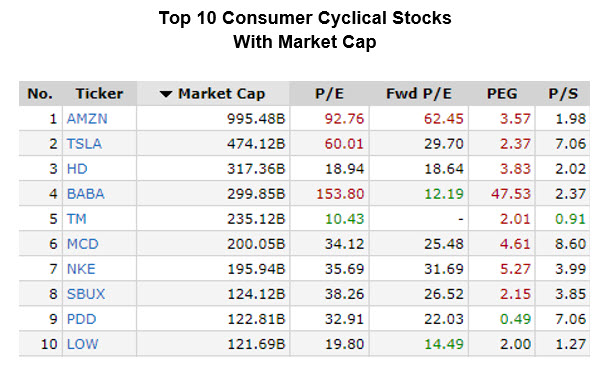

It’s no surprise that these two household names’ market caps are in the top 10 of Consumer Cyclical stocks, where peers such as Amazon.com (AMZN) and Tesla (TSLA) reside at $1 trillion and $500 billion, respectively. McDonald’s stock stands in sixth place at $200 billion, with Nike just below at $195.8 billion. To put this into perspective, NKE’s covid low was $100 billion and MCD’s held at or near $100 billion between 2011-2017. We’ve talked in this space about the psychological effect of round-number levels such as $100 and $200, so keep those in mind when tracking MCD and NKE’s price action in the next few months.

Regardless of which end of the bullish-bearish spectrum traders want to bet on, options premium is looking affordable. Nike and McDonald’s stock Schaeffer’s Volatility Index (SVI) readings of 25% and 16% it in the 3rd and 7th annual percentiles, respectively. This means option traders are pricing in extremely low volatility expectations at the moment.

Image and article originally from www.schaeffersresearch.com. Read the original article here.