The Zacks Retail and Wholesale has struggled in 2022, facing high inflation, down more than 25% and underperforming the general market by a fair margin.

A big-time player in the realm, Williams-Sonoma WSM, is slated to unveil Q3 earnings on November 17th, after the market close.

Williams-Sonoma, Inc. is a multi-channel specialty retailer of premium quality home products. Incorporated in 1973, the company has five brands, each of which are operating segments.

Currently, the retailer carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How does everything else shape up heading into the release? Let’s take a closer look.

Share Performance & Valuation

WSM shares have nearly traded in line with the general market year-to-date, down roughly 18% vs. the S&P 500’s decline of 17%.

Image Source: Zacks Investment Research

Over the last month, however, WSM shares have tacked on a strong 12% in value, easily outpacing the general market’s 7% gain.

Image Source: Zacks Investment Research

The strong price action of WSM shares over the last month indicates that buyers have stepped up in a big way.

WSM shares aren’t expensive; the company’s forward earnings multiple sits at 8.0X, well below its 13.8X five-year median and reflecting a sizable 67% discount relative to its Zacks Retail and Wholesale sector.

Further, the company sports a Value Style Score of an A.

Image Source: Zacks Investment Research

Quarterly Estimates

Two analysts have upped their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $3.78 indicating a 14% Y/Y uptick in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line is in solid standing also; the Zacks Consensus Sales Estimate of $2.2 billion suggests a 5.3% Y/Y increase.

Quarterly Performance

Williams-Sonoma has an impressive earnings track record, exceeding the Zacks Consensus EPS Estimate in 19 consecutive quarters. Just in its latest release, the company registered a 9.3% bottom-line beat.

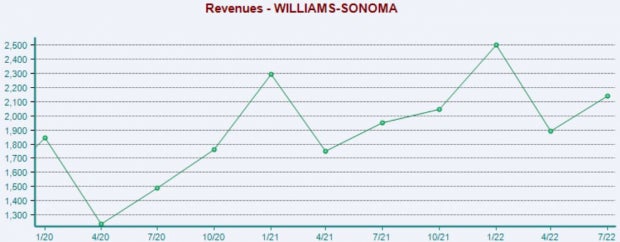

Revenue results have also been mightily strong; WSM has exceeded sales expectations in nine of its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

WSM shares reside in the red year-to-date but have easily outpaced the general market over the last month.

The company’s shares aren’t expensive, with its forward earnings multiple well beneath its five-year median and Zacks sector average.

Analysts have primarily been bullish in their earnings outlook, with estimates indicating Y/Y increases in both revenue and earnings.

WSM has consistently exceeded quarterly estimates, chaining together a long streak of bottom-line beats.

Heading into the release, Williams-Sonoma WSM carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of -1.2%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WilliamsSonoma, Inc. (WSM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.