Trading 33% off its highs, one company investors will want to keep an eye on when it reports Q3 earnings on October 25 is Alphabet GOOGL. This will also be Alphabet’s first earnings release since its 20-1 stock split in July.

Image Source: Zacks Investment Research

Alphabet shares are broken into two classes GOOG (Class C) and GOOGL (Class A) with the difference being the ladder having voting rights. Alphabet’s earnings will give another perspective as to the effects of slowing advertising revenue as marketers have cut back their spending during the economic downturn.

Alphabet relies on a significant amount of ad revenue similar to social media companies like Snap SNAP, Twitter TWTR, and Meta Platforms META. Wall Street will certainly be monitoring profits from Alphabet’s core business Google with the majority of its revenue coming from advertising. Continued growth in Google cloud will also be significant and Alphabet’s YouTube ad revenue will provide further insight into the state of advertising spending.

Advertising Dominance

Alphabet’s Google was the leading platform in the U.S. digital ad space in 2021, outpacing Meta Platform’s Facebook and Amazon AMZN. Google controlled an estimated 26% of the nation’s total online ad market.

YouTube has also shown Alphabet’s dominance in producing massive ad revenue. In Q4 of 2021, Alphabet’s YouTube ad sales alone topped Netflix’s total revenue for the quarter at $8.6 billion. Last year, YouTube brought in $29 billion in ad revenue, up 46% from 2020.

Advertising growth has continued for Alphabet this year while others companies have suffered. Most recently, during Q2 YouTube ads were up 5% from the year prior at $7.34 billion and Google advertising was up 11% at $56.28 billion.

This led to a 13% increase in top line revenue last quarter at $69.68 billion. However, the company missed earnings expectations by 4.7% at $1.27 per share. Also, while Google’s search business managed well amid rising inflation, its YouTube division started to show signs of slowing with a 14% decline in growth from this year’s first quarter despite being up YoY from Q2 2021.

Investors will hope that Google search continues its dominance and that the YouTube division can show some continued growth on a larger scale despite tougher operating environments and increased competition from TikTok.

Q3 Outlook

The Zacks Consensus Estimate for GOOGL’s Q3 earnings is $1.25 per share, which would be a decline of -11% from Q3 2021. Sales for Q3 are expected to be up 9% at $58.35 billion. This is an indication that operation costs are weighing on GOOGL’s profits.

Along with ad revenue, investors will want to monitor Alphabet’s Cloud segment closely during the company’s Q3 release. Last quarter Cloud revenue grew 36% to $6.27 billion but had an operating loss of $858 million, which was up from a loss of $591 million during Q2 2021.

Earnings estimates for the period have gone down from $1.35 at the beginning of the quarter. Year over year, GOOGL earnings are expected to decline -9% but rise 14% in FY23 at $5.80 per share. Top line growth is expected, with sales projected to be up 11% this year and rise another 10% in FY23 at $260.40 billion.

Performance & Valuation

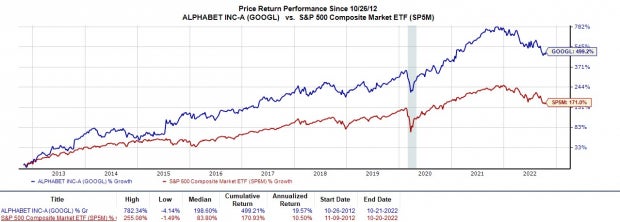

Year to date GOOGL is down -30% to underperform the S&P 500’s -24% as economic conditions have been harder on tech stocks. However, over the last decade, GOOGL is still up +499% to crush the benchmark.

Image Source: Zacks Investment Research

This year’s drop in GOOGL could turn out to be an opportunity for longer-term investors given the company’s stellar performance in the past. Trading around $101 a share, GOOGL has a P/E of 19.1X. This is on par with the industry average and nicely below its decade high of 37X and the median of 26.5X.

Image Source: Zacks Investment Research

Bottom Line

Alphabet’s Q3 earnings will be much anticipated for insight into the tech giant’s performance as inflation concerns accelerated throughout the quarter. Wall Street will have a scope on GOOGL’s earnings to see how the most visible online platforms are being affected by rising inflation and economic uncertainty.

GOOGL currently lands a Zacks Rank #3 (Hold) and its fiscal 23 outlook looks promising despite the challenges the company faces this year. GOOGL’s Internet-Services Industry is also in the top 26% of over 250 Zacks Industries. Even better, the Average Zacks Price Target offers 47% upside from current levels.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don’t miss your chance to download Zacks’ top 5 stocks for the electric vehicle revolution at no cost and with no obligation.>>Send me my free report on the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.