The famous saying that investors should never put their eggs in one basket derives from the general idea that diversification strengthens a portfolio.

United Health Group (UNH) and United Rentals (URI) are two giants in their respective industries that can offer diversity and perhaps unite investors’ portfolios with strong performances.

Let’s see if now is a good time to buy United Health and United Rentals stock.

Diverse Exposure

Sharing a common reference in their names, United Health offers diverse exposure to the healthcare sector while United Rentals does the same to the construction and building materials space.

United Health provides a wide range of healthcare products and services, such as health maintenance organizations (HMOs), point of service plans (POS), preferred provider organizations (PPOs), and managed fee-for-service programs. United Health has the largest and most diverse membership base in the managed-care organization market.

Image Source: Zacks Investment Research

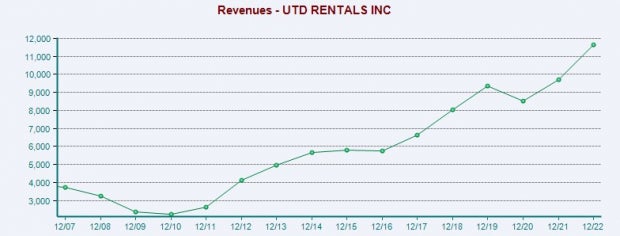

As for United Rentals, URI is the largest equipment rental company in the world. United Rentals’ customer base includes construction and industrial companies, utilities, municipalities, government agencies, independent contractors, homeowners, and other individuals who use equipment for projects that range from simple repairs to major renovations.

Image Source: Zacks Investment Research

Performance & Valuation

Year to date, United Rentals stock is up +10% to top United Health’s -10% and the S&P 500’s +6%. Even better, United Rentals stock has soared +312% over the last three years with United Health up +99% to both top the benchmark’s +64%.

Furthermore, over the last decade, United Health and United Rentals stocks have climbed over 600% to largely outperform the broader market.

Image Source: Zacks Investment Research

United Health stock trades at $472 per share and 18.8X forward earnings which is above the industry average of 13.4X but on par with the S&P 500’s 18.6X. Plus, United Health is an industry leader and trades 30% below its decade high of 26.6X and close to the median of 18.3X.

In comparison, United Rentals shares trade at $395 and just 9.2X forward earnings. This is nicely beneath the benchmark and its own industry average of 13.4X. Even better, United Rentals stock trades 49% below its decade-long high of 18X and at a 17% discount to the median of 11.1X.

Image Source: Zacks Investment Research

Growth & Outlook

On top of its very attractive valuation, United Rentals’ earnings are forecasted to leap 29% this year to $41.92 per share compared to EPS of $32.50 in 2022. Fiscal 2024 earnings are expected to rise another 9%.

Earnings estimates revisions have trended higher throughout the quarter. On the top line, sales are forecasted to climb 20% in FY23 and edge up another 4% in FY24 to $14.52 billion.

Image Source: Zacks Investment Research

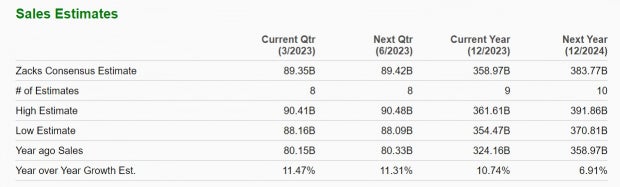

Pivoting to United Health, earnings are projected to rise 12% in FY23 and jump another 13% in FY24 at $28.22 per share. Earnings estimates are slightly up over the last 90 days. Sales are expected to be up 10% this year and rise another 7% in FY24 to $383.77 billion.

Image Source: Zacks Investment Research

Takeaway

At the moment United Health and Untied Rentals stock both sport a Zacks Rank #2 (Buy). The top and bottom line growth of both companies is still impressive and indicates there could be more upside in their stocks.

This could definitely be the case when considering the historical performances of United Health and Untied Rentals stock. To that point, investors may want to consider buying both stocks as they offer diversity and dominance in their respective industries.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don’t miss your chance to download Zacks’ top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

>>Send me my free report on the top 5 EV stocks

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.