Index investing is an attractive alternative to picking and choosing a name within a sector

Subscribers to Chart of the Week received this commentary on Sunday, May 14.

Below is an excerpt from our latest episode of our Schaeffer’s Market Mashup podcast! This episode is an insightful conversation between the Head of Options Content for Nasdaq, Kevin Davitt, and Schaeffer’s own Managing Editor, Patrick Martin. To listen to the entire episode, access the media player at the bottom of this page.

Patrick: You mentioned this earlier about the NASDAQ being the benchmark of the 21st century. I think I pulled that from your Twitter. But let’s dive a little deeper what are some areas within that space that you’re monitoring that you think are very exciting going forward, and that a an investor looking to dip their toe in might want to know about?

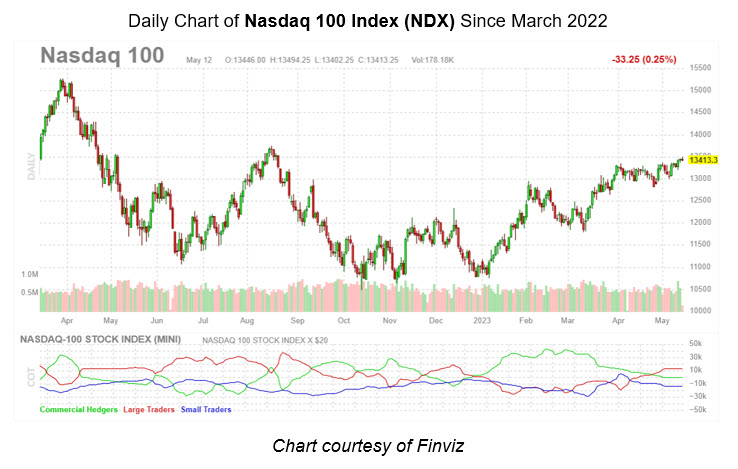

Kevin: Yeah. To a certain extent, I think that all of this is informed by my own personal experience. And I started in this business in the late 90s. And back then, at CBOE when I was on a trading floor like the S&P 100 Index (OEX) was sort of the bellwether option product. The Dow was also a very big deal. And over time, the S&P 500 Index (SPX) became that that real crux of activity. And now you’re asking about the Nasdaq-100 Index (NDX), and I won’t go into sort of the overall makeup, people can use a Google search and look at the constituents and what sectors they fall in. I will point out with respect to sort of the rate hike cycle, and the macro backdrop currently, that financials are not included in the Nasdaq-100. And perhaps that’s interesting against a very inverted yield curve, and the most significant inflation we’ve seen in decades.

I also do think about its construction. And I think about consumer brands. And brand equity matters. So if your listeners do go through and take a list at the NDX constituents, I think they’ve recognized about 80% of them, because they interact with those brands, or they use their technology or they shop there. And then, going along your point about growing up; I didn’t grow up in a house where investing was discussed or even very much a focus. But I do remember my mom talking about Peter Lynch, who launched and manage the Magellan Fund at Fidelity and he’s one of the more successful money managers in history. And one of his tenants for investing was observational, like asking yourself — are you investing in companies that you know, brands that you understand, and places that you observe that are full of people? and I think with the Nasdaq-100 that’s likely the case.

Beyond that, I am interested in what we’ve seen this year or since equity markets bottomed lately. Last year, the leadership on the part of mega cap, primarily tech companies, is significant. If I stretch out my timeframe and take a more panoramic view, the NDX, its outperformance relative to the SPX has been very steady for the past decade if not longer, and it’s not like the late 1990s, where the relationship between these two indices got very out of whack in a hurry. When companies were hustling to just tack “.com” onto the end of their name.

Companies and capital markets are moving in a direction that in my opinion, benefits the way the Nasdaq-100 is constructed. And then, again, if listeners are looking to do some work on their own, you could ask yourself if you really want and need exposure to. And this is not a knock, but for some of the bottom names in the S&P 500, look at the 400 through 500. I’m not going to pick on some specific companies. But are those brands that you want dollars in? If that’s Yes, fantastic. If it’s no, maybe the Nasdaq-100 is right for you. Understanding the construction and making informed decisions with respect to or after that knowledge, I think is a great way to really kind of sharpen your investing skills.

Patrick: I love what you said about brand equity. Because I think that’s something that someone looking to dive in is a little scared of saying, “Oh, well, I don’t want to look through a bunch of white paper. And I’m not sure what this company does.” You remove a lot of that uncertainty I think with the NDX.

Kevin: I agree with you. And even from a broader standpoint, I think that’s another reason that index investing is here to stay as opposed to picking and choosing a name within a sector. That can work out well, but it’s difficult to pick that winner over a longer timeframe. And allocating smaller portions of investable assets to a name or two you believe in fantastic. But in terms of just trying to grow a pool of money over time, I think it’s easier. It’s efficient in terms of fees, and I don’t think it’s going anywhere.

Image and article originally from www.schaeffersresearch.com. Read the original article here.