Stocks threw on the brakes in Friday’s session to end the week. Investors continue to digest banking concerns and, of course, the Fed’s looming decision. Many expect a 25bps hike, while another side of the aisle calls for a pause.

While the Fed’s decision remains in focus, it’s worth checking in on the turmoil within banking, especially following the fallout of Silicon Valley Bank.

Now, Credit Suisse CS has become the center of attention following concerns regarding its stability.

And just on Sunday, it was revealed that Switzerland’s largest bank, UBS UBS, agreed to buy Credit Suisse. Valued at roughly $3.25 billion, the purchase price is a significant discount relative to the bank’s value last Friday after markets closed.

Needless to say, it’s a massive development, as it reflects an attempt to limit financial contagion amid a somewhat-cloudy economic outlook.

And in an extreme move, the deal won’t need shareholders’ approval following the Swiss government’s modification of the law.

However, many approve of the deal, including Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen, who made the following statement yesterday on March 19th –

“We welcome the announcements by the Swiss authorities today to support financial stability. The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient. We have been in close contact with our international counterparts to support their implementation.”

CS shares have been stuck in a nasty downtrend for years now, down more than 94% over the last five years and widely underperforming relative to the S&P 500. This is illustrated in the chart below.

Image Source: Zacks Investment Research

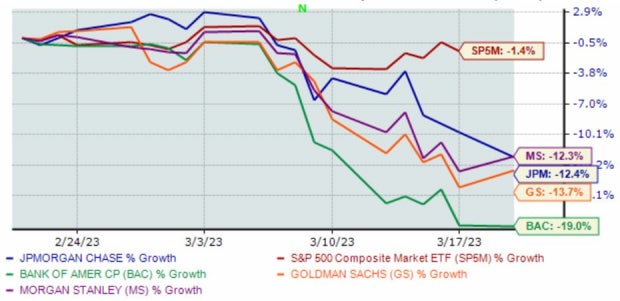

And over the last month, many of the big banks, including JPMorgan JPM, Goldman Sachs GS, Bank of America BAC, and Morgan Stanley MS, have also felt the drag, widely underperforming relative to the S&P 500 over the last month.

Image Source: Zacks Investment Research

With banking concerns and a looming Fed decision in focus, it’s reasonable to expect spikes of volatility throughout the trading week.

This Little-Known Semiconductor Stock Could Be Your Portfolio’s Hedge Against Inflation

Everyone uses semiconductors. But only a small number of people know what they are and what they do. If you use a smartphone, computer, microwave, digital camera or refrigerator (and that’s just the tip of the iceberg), you have a need for semiconductors. That’s why their importance can’t be overstated and their disruption in the supply chain has such a global effect. But every cloud has a silver lining. Shockwaves to the international supply chain from the global pandemic have unearthed a tremendous opportunity for investors. And today, Zacks’ leading stock strategist is revealing the one semiconductor stock that stands to gain the most in a new FREE report. It’s yours at no cost and with no obligation.

>>Yes, I Want to Help Protect My Portfolio During the Recession

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

Credit Suisse Group (CS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.