Earnings season is in full gear now, and investors are more than anxious for companies to unveil what has transpired behind the scenes.

It’s been a better-than-expected earnings season so far, with the “earnings apocalypse” yet to materialize. Still, earnings estimates fell notably over the last several months.

A giant in the wireless realm, Verizon Communications VZ, is gearing up to report earnings on October 21st before the market open.

Verizon offers communication outlets in the form of local phone, long-distance, wireless, and data services.

Currently, the communications titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.

How does everything else stack up for the company heading into the release? Let’s take a closer look.

Share Performance & Valuation

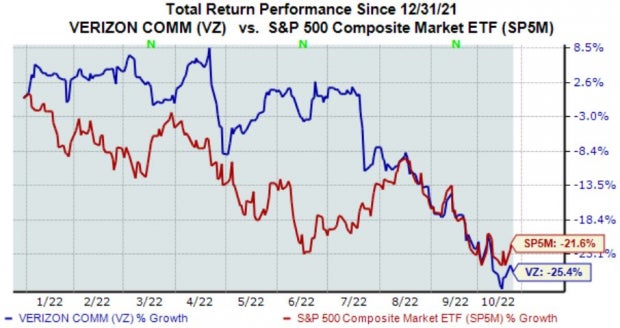

Year-to-date, it’s been rough sailing for VZ shares, down more than 25% and lagging behind the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, the story has remained the same; VZ shares have widely underperformed the S&P 500, down nearly 24%.

Image Source: Zacks Investment Research

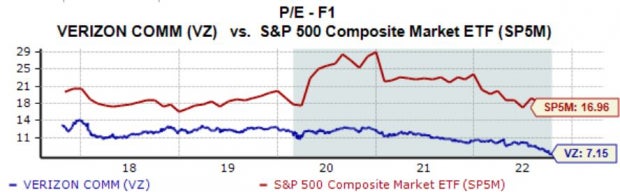

Still, VZ shares are cheap; shares trade at a 7.2X forward earnings multiple, nowhere near the five-year median of 11.6X and representing a sizable 58% discount relative to the S&P 500.

The company sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have primarily been bearish in their earnings outlook, with three negative estimate revisions coming in over the last several months. The Zacks Consensus EPS Estimate of $1.28 reflects a 9% decline in earnings Y/Y.

Image Source: Zacks Investment Research

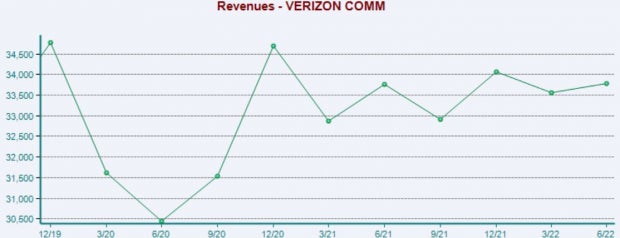

However, the company’s top-line is in much better shape – the Zacks Consensus Sales Estimate of $33.8 billion suggests Y/Y revenue growth of nearly 3%.

Quarterly Performance & Market Reactions

Verizon has consistently exceeded earnings estimates, penciling in eight EPS beats across its last ten quarters. In its latest print, however, the company fell short of earnings expectations by roughly 2%.

Top-line results have also been consistently strong, with VZ registering seven revenue beats over its last ten reported quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Additionally, it’s worth highlighting that shares have moved downwards following each of VZ’s last three quarterly reports, all by at least 3.5%.

Putting Everything Together

VZ shares have lagged behind the general market across several timeframes in 2022, indicating that bears have pushed bulls out of the arena.

Shares are relatively cheap, with the company’s forward earnings multiple residing well beneath its five-year median.

Analysts have been primarily bearish within their earnings outlook, and estimates suggest a Y/Y decline in earnings but an uptick in revenue.

Further, the company has consistently exceeded quarterly estimates, but the market hasn’t responded well across its last three prints.

Heading into the release, Verizon Communications VZ carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 0.7%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention. See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.