Airline earnings are expected to be solid, but guidance is more important with an economic downturn, rising rates, and climbing operating costs. Demand for travel is high right now but investors will want to see the outlook in terms of bookings and reservations for Q4 and fiscal 2023.

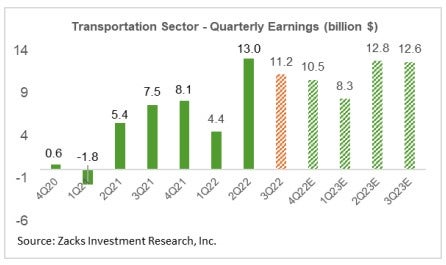

The Transportation sector’s Q3 earnings are expected to be up +48.1% from the year earlier level, as the sector’s profitability picture has notably improved. This is a good sign for the Transportation-Airline Industry.

Image Source: Zacks Investment Research

United Airlines UAL will release its Q3 earnings on October 18th.

United Airlines is the second-biggest airline in the U.S. in terms of passengers carried with destinations in Asia, Europe, the Middle East, and Latin America.

UAL’s outlook will help investors get a better gauge on the global economic slowdown and how much inflation is impacting travel. More importantly, trading 38% off its 52-week highs investors will want to see how any rising operating costs will affect the company’s earnings.

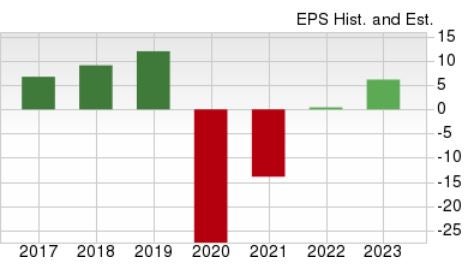

Image Source: Zacks Investment Research

United returned to profitability in Q2. But CEO Scott Kirby said it was focused on confronting three risks that could grow over the next 6-18 months: industry-wide operational challenges, record fuel prices, and the increasing possibility of a global recession.

This will certainly need to be monitored by investors as despite TPI inflation (Travel Price Index) being down 1.8% in August, airline fares were up 33% year over year. While the Transportation sector’s earnings are expected to be up in Q3, inflated prices could start to weigh on consumer demand and is an indicator of rising operating costs for airlines.

Performance

UAL is down -22% year to date, with much of the fall coming during the second quarter as inflation concerns began taking their toll on the stock. The decline is not as steep as the S&P 500’s -25% YTD drop but United has underperformed its peer group’s -13%.

Image Source: Zacks Investment Research

Despite the large decline over the last year, UAL is still up +68% over the last decade to outperform its peer group’s +57%.

Image Source: Zacks Investment Research

Outpacing competitors such as American Airlines AAL and Delta Airlines DAL could also be key for UAL stock. As we can see form the above chart, UAL’s price performance is in the middle of the pack over the last two years, outperforming DAL but underperforming AAL.

Outlook

The Zacks Consensus Estimate for UAL’s Q3 earnings is $2.21 per share, expected to climb swing from a loss in Q3 2021 and rise 316%. Sales for Q3 are also expected to be up 64% at $12.70 billion. Estimates for the period have gone up significantly over the last 90 days. Earnings expectations have increased 37% from $1.61 at the beginning of the quarter.

Year over year, UAL’s earnings are expected to be back in the black, swinging from an adjusted loss of -$13.94 per share in FY21 to +$0.45 in 2022. FY23 earnings are set to rebound another 1,189% to hit $5.80 per share. While this is not back to pre-pandemic levels, the large earnings climb is certainly a step in the right direction.

Solid top line growth is also expected, with FY22 sales projected to climb 78% and another 15% in FY23 to $50.56 billion. UAL’s fiscal 2022 and FY23 revenue is expected to exceed pre-pandemic levels at $40.80 billion in 2019.

Valuation

Currently trading around $34 a share, UAL has a P/E of 74.8X. This is much higher than the industry average of 12.3X. However, UAL’s high valuation is leveling off quickly with its earnings rebound. UAL is trading much lower than the 747.2X high it saw earlier in the year. And looking at the forward 12 months, UAL’s 7.3X is close to its median over the last decade of 8.8X.

Bottom Line

UAL currently lands a Zacks Rank #3 (Hold) and its Transportation-Airline Industry is in the bottom 32% of over 250 Zacks Industries. However, with earnings on a post-pandemic rebound, a Q3 beat and positive guidance could help UAL stock start to take off.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.