Every Wednesday, we delve into the latest fintech updates from across the UK. This week brings updates from the FCA, TSB, iwoca, PayPal, Zilch and more.

FCA blocked over 8,000 ads in 2022

The Financial Conduct Authority (FCA) required UK firms to edit or completely remove 8,582 promotions in 2022. This number is around 14 times higher than was required in 2021.

The FCA explained that people struggling with finances due to the cost of living crisis could be more susceptible to scammers or adverts for unregulated financial products.

The regulator also expressed growing concern regarding so-called ‘fin-fluencers’. It warned that unauthorised individuals should not advise people concerning certain investments. This could result in action being taken against them. The FCA acted against a number of social media influencers in 2022.

Sarah Pritchard, executive director of markets for the FCA, said: “Our expectations remain the same. Financial promotions must be fair, clear and not misleading. What has changed is the FCA’s approach. By drawing on better technology, we’re finding poor quality or misleading ads quicker. And where we find them, we’re stepping in to make firms improve them or remove them entirely.

“This year, we will continue to put the pressure on people using social media to illegally promote investments, which put people’s hard-earned money at risk.”

New TSB pilot banking pods launch

TSB has launched two new pilot banking pods in Wigan and Wood Green (North London). A third TSB Pod is set to launch in Luton later in Spring.

The TSB Pods are semi-permanent structures containing a check-in area to meet and greet customers; alongside a dedicated private space for customer meetings. The Pods use ATM network NoteMachine’s BankHive technology to retain customers’ access to cash withdrawal services.

The new Wigan and Luton TSB Pods are being introduced to replace local branch services planning to close in May. The Wood Green pod becomes a new location for TSB. Deposit facilities are due to be added in the coming months.

Gary Jones, customer delivery director for TSB, said: “Many of our customers are banking differently. We see both an increase in their use of technology and in customers seeking help to do their banking in more convenient ways. TSB remains committed to offering face-to-face banking services and, with pilots like the TSB Pods underway and an increase in our video banking offer, we continue to innovate in how we can serve our customers in ways that work best for them.”

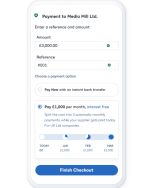

iwoca and Quickbooks provide BNPL options for businesses

Business loan provider iwoca has completed the integration of its B2B payment solution iwocaPay with Quickbooks’ accounting software package.

Integrating iwocaPay into QuickBooks’ platform aims to support hundreds of thousands of businesses to get paid faster. The integration now provides businesses with the option to offer buy now, pay later to their business customers.

Lara Gilman, co-lead of iwocaPay, explained how the news brings support to businesses. Gilman said: “We’re delighted that QuickBooks users now have the option to include iwocaPay on their invoices, so that they can offer business customers buy now, pay later, without carrying the credit or late payment risk themselves.

“The ability for them to offer this flexibility to customers during today’s turbulent economic times will help B2B businesses attract more customers and make more money, whilst having better control of their own cash flow.”

Co-op adds PayPal as payment option

Food retailer Co-op has partnered with digital payment provider, PayPal, to offer an additional payment option for purchases of online home delivery orders and click-and-collect via Co-op’s online shop.

Vincent Belloc, managing director at PayPal UK, explained how the partnership brings more convenience to Co-op customers. Belloc said: “PayPal has 32 million active accounts in the UK, and is trusted by shoppers who buy, sell, and send money – without sharing their financial information.

“E-commerce has always been about giving consumers a convenient way to buy what they want, when they want, and being able to pay for it how they want. We could not be more delighted to collaborate with Co-op to offer additional convenience and choice online for communities across the UK when they shop for groceries.”

Zilch supports StepChange

UK fint

ech company Zilch has partnered with debt advice charity StepChange, to help Zilch customers access help. The partnership comes in light of the current cost of living crisis.

Zilch becomes the first provider of credit via buy now pay later to fully integrate StepChange Direct into its platform. Zilch will make financial contributions to StepChange through the ‘Fair Share’ funding mechanism, to support the charity.

Philip Belamant, CEO and co-founder of Zilch, said: “The entire ethos of Zilch is about being customer-first. We’ve built the business around doing the right thing by our customers, even if it’s difficult, every time.

“To Zilch, this partnership is a natural and obvious one. Why would any responsible lender of credit not want to align with an establishment such as StepChange? It is doing so much to support people in these hard times.”

Image and article originally from thefintechtimes.com. Read the original article here.