Transdigm TDG, an aerospace manufacturing company, reports earnings Tuesday, February 7 before the market opens. In 2006 Transdigm went public on the New York Stock Exchange, and the stock has been incredibly successful since then, returning nearly 28% annualized for a cumulative return of 6,400%. Is it possible to maintain this breakneck appreciation?

Transdigm, originally TD Holding Company, was founded in 1993 with a $10 million investment. The company was born out of leveraged buyout by private equity firm Kelso and Company, and the founders Nicholas Howley and Douglas Peacock in order to acquire and consolidate four industrial aerospace companies from IMO Industries Inc.

TDG originally manufactured and marketed a small group of aircraft components such as batteries, pumps and, and fuel connectors. The company grew consistently over time through acquisitions completing more than 60 of them in the first 25 years. Between 1993 and 1998 TDG grew revenues 25 times.

Image Source: Zacks Investment Research

Earnings Expectations

Transdigm’s revenue comes from two primary segments. The companies airframes segment produces systems such as locking devices, security components, lavatory components, and parachute systems. TDG’s power and control segment produces actuators, specialized pumps, and other mechanical controls. Airframes make up 44% of revenue and power and control 53%. A third smaller segment, non-aviation producing refueling systems and ground transportation makes up about 3%.

Transdigm is coming into this earnings period with momentum. Commercial air travel has seen a resurgence, and government spending is up significantly, particularly in the defense sector. Sales estimates for the coming quarter are projected to grow 14.3% YoY to $1.36 billion. Earnings are looking strong too, projecting a 44% increase YoY, bringing quarterly EPS to $4.31 a share based on Zack’s estimates.

Image Source: Zacks Investment Research

Catalysts

Air travel is in a unique position currently. At one end of the spectrum, commercial air travel has picked up significantly since the Covid pandemic ended. Travel and hospitality continue to be some of the strongest sectors in the economy. On the other end, professional travel has dropped considerably, as has international travel.

During the Covid pandemic, we saw Warren Buffett exit all his airline investments, because he believes travel has changed structurally. It will take several years to figure out how airlines will adapt and see what the business travel dynamic evolves into.

Unique Edge

Transdigm has a unique advantage; it is run like a private equity firm or conglomerate. Management is always looking to diversify their product offerings through acquisitions. This structure can provide appealing risk to reward, as the business is run like an alternative investment. Alternative investment, meaning an asset that isn’t a traditional stock or bond, like a Hedge Fund, Real Estate, or Investment fund. What is appealing about these vehicles is that run properly, they can diversify the returns of a typical stock or bond portfolio.

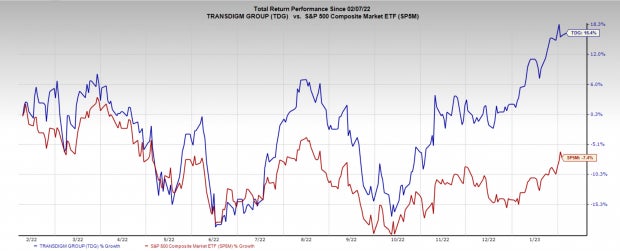

Although TDG remained correlated to the market over the past year, at the end of twelve months, it provided a return well in excess of the market.

Image Source: Zacks Investment Research

Valuation

Transdigm is a well-diversified and well managed business positioned for long-term sales and earnings growth. However, with a one year forward P/E ratio of 34x, its valuation is well above the industry average. Transdigm’s five-year low came in at 15x, while the high is 56x. This leaves TDG with quite a rich valuation currently.

The unique edge of TDG, its overall business strategy as an alternative-like investment does earn it a premium valuation though. It has thus far proven to be a highly asymmetric investment.

Image Source: Zacks Investment Research

Conclusion

Transdigm is a fantastic business, no doubt about it. But with a relatively high valuation, and a shifting commercial travel dynamic, the stock may run into some resistance.

Alternatively, defense spending is up considerably. With the war in Ukraine seeming to have no end in sight, this should be a tailwind for TDG and other defense contractors. Furthermore, with the recent Chinese spy balloon, among other events with China, geopolitical tension is rising. Fears of further escalation in international wars are becoming more founded.

Just Released: Free Report Reveals Little-Known Strategies to Help Profit from the $30 Trillion Metaverse Boom

It’s undeniable. The metaverse is gaining steam every day. Just follow the money. Google. Microsoft. Adobe. Nike. Facebook even rebranded itself as Meta because Mark Zuckerberg believes the metaverse is the next iteration of the internet. The inevitable result? Many investors will get rich as the metaverse evolves. What do they know that you don’t? They’re aware of the companies best poised to grow as the metaverse does. And in a new FREE report, Zacks is revealing those stocks to you. This week, you can download, The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks. It reveals specific stocks set to skyrocket as this emerging technology develops and expands. Don’t miss your chance to access it for free with no obligation.

>>Show me how I could profit from the metaverse!

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.