There is a long list of companies that will be reporting their quarterly results on Thursday, August 10.

Among them there are quite a few top-rated stocks, and here are three that investors will want to keep an eye on.

Alibaba BABA: After Amazon’s AMZN impressive second-quarter report last Thursday, many eyes will be on Chinese e-commerce giant Alibaba. The company will be reporting its fiscal first-quarter results and currently sports a Zacks Rank #2 (Buy).

Wall Street will be seeing if Alibaba shows signs of prioritizing profitability rather than expansion, similar to Amazon. Emphasis on increased profitability sent Amazon shares soaring after its Q2 report and investors are certainly hoping Alibaba can do the same.

According to Zacks estimates, Alibaba’s Q1 earnings are forecasted to rise 12% to $1.97 per share compared to EPS of $1.75 in the prior-year quarter. Sales are expected to be virtually flat from a year ago at $30.79 billion. Notably, Alibaba has beaten earnings expectations in its last six quarterly reports.

Image Source: Zacks Investment Research

Applied Industrial Technologies AIT: Among the industrial products sector, Applied Industrial Technologies stock is intriguing and currently lands a Zacks Rank #2 (Buy).

Applied Industrial is a distributor of various value-added industrial products and is renowned for its engineering, design, and systems integration services. The company’s fiscal fourth-quarter earnings are expected to be up 8% at $2.18 per share with sales forecasted to rise 5% to $1.12 billion. Applied Industrial has put together a string of nice earnings beats and has now topped expectations for four straight quarters.

Image Source: Zacks Investment Research

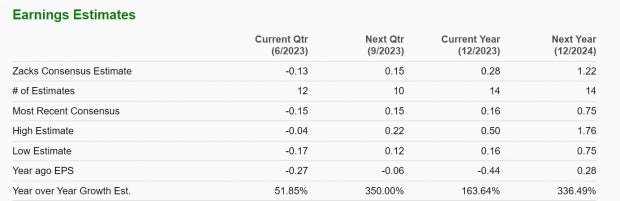

CyberArk Software CYBR: Lastly, CyberArk Software is another tech company many investors will be watching and also sports a Zacks Rank #2 (Buy) with stellar quarterly growth expected.

There has been much buzz about the software security solution provider’s expansion in recent years. To that point, second-quarter sales are projected to leap 21% to $173.20 million. CyberArk’s Q2 earnings are expected at an adjusted loss of -$0.13 a share and nicely up from a loss of -$0.27 per share a year ago.

For better measure, CyberArk’s fiscal 2023 earnings are now forecasted to soar at $0.28 per share compared to an adjusted loss of -$0.44 a share in 2022. More impressive, FY24 earnings are anticipated to skyrocket another 336% to $1.22 per share. CyberArk has surpassed earnings expectations in its last four quarterly reports.

Image Source: Zacks Investment Research

Takeaway

Alibaba, Applied Industrial Technologies, and CyberArk Software stock are intriguing ahead of their quarterly reports. Strong results may help these stocks take off and they could be buy the dip candidates if reports aren’t as favorable or there is an overaction in the market.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.