It’s finally time for big tech to take the spotlight and unveil quarterly results. Needless to say, investors are more than ready to finally see what has transpired behind the scenes.

We’ve received several notable quarterly reports so far, including those from Microsoft MSFT, Netflix NFLX, and Tesla TSLA.

Now, the legendary Apple AAPL is gearing up to unveil its quarterly results on Thursday, February 2nd, after the market close.

How does the titan stack up heading into the release? Let’s take a closer look.

Key Metrics

Of course, iPhone revenue will be a closely monitored metric, as it’s been the company’s flagship product and primary source of income. In addition, the results will slightly gauge how many consumers chose to stay with their current iPhone model rather than upgrade in the face of a harsh economic environment.

For the quarter, the Zacks Consensus Estimate for iPhone revenue stands firm at $68.7 billion, indicating a decrease of 4% Y/Y. Still, it’s worth noting that Apple has exceeded our consensus iPhone revenue estimate in three of its last four quarters, with one marginal miss coming in its latest release.

In addition, revenue from the company’s services, including Apple TV+, Apple News+, and Apple Card, has become a solid contributor to its top line, another metric investors will look out for.

Currently, the Zacks Consensus Estimate for Apple’s Services revenue stands at $20.5 billion, suggesting an increase of nearly 6% Y/Y.

Quarterly Estimates

Analysts have taken a bearish stance for the quarter to be reported, with seven downward earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $1.93 suggests a decrease of roughly 8% Y/Y.

Image Source: Zacks Investment Research

Our consensus revenue estimate for the quarter sits at $121.2 billion, indicating a decline of roughly 2% Y/Y.

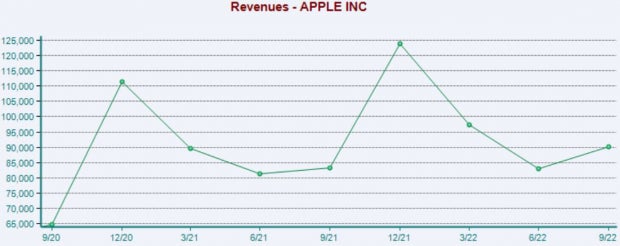

Quarterly Performance

Apple has managed to deliver better-than-expected results despite facing a challenging business environment, exceeding the Zacks Consensus EPS Estimate in four consecutive quarters.

Just in its latest release, the titan registered a 2.4% EPS beat paired with a 1.9% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

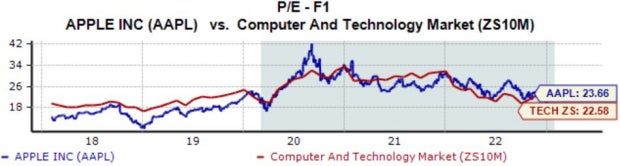

Valuation

Currently, Apple shares trade at a 23.7X forward earnings multiple, nearly in line with its five-year median and Zacks sector average but nowhere near highs of 31.3X in 2022.

Image Source: Zacks Investment Research

Further, the company’s forward price-to-sales ratio presently sits at 5.7X, again nearly in line with its five-year median and below highs of 7.7X in 2022.

Image Source: Zacks Investment Research

Putting Everything Together

Perhaps the most popular stock in the market, Apple AAPL, is slated to unveil quarterly results this week.

Regarding the results, investors will be laser-focused on iPhone revenue, as it’s the company’s primary source of income and a slight indicator of consumer health.

In addition, revenue from the company’s services will also be closely monitored, as the segment has quickly become a solid contributor to top line growth.

Analysts have been primarily bearish for the quarter to be reported, with estimates indicating a pullback in earnings and revenue Y/Y.

Further, the company’s valuation multiples have pulled back, with its forward price-to-sales and forward earnings multiple residing at their respective five-year medians.

Heading into the print, Apple is currently a Zacks Rank #3 (Hold) with an Earnings ESP Score of -0.3%.

Just Released: Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for 2023?

From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%. Our Director of Research has now combed through 4,000 companies covered by the Zacks Rank and handpicked the best 10 tickers to buy and hold in 2023. Don’t miss your chance to still be among the first to get in on these just-released stocks.

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.