Quarterly results from large retailers will highlight this week’s earnings lineup but there are a few healthcare companies that investors will want to pay attention to as well.

This is especially true if broader markets continue to lose some steam as healthcare is always essential and may be a space to look at amid a downturn.

With that being said, here are two top-rated Zacks Medical sector stocks that are worthy of consideration ahead of their quarterly results on Tuesday, August 15.

Cardinal Health CAH

Cardinal Health’s stock stands out at the moment with a Zacks Rank #2 (Buy) and its Zacks Medical-Dental Supplies Industry is in the top 13% of over 250 Zacks industries.

The company stands to benefit from its booming business industry as the second-largest pharmaceutical distributor in the United States. In addition to this Cardinal provides a wide range of medical supplies to international markets such as Canada, Europe, South America, and Asia.

Set to report its fiscal fourth-quarter results on Tuesday, Cardinal’s earnings are projected to soar 41% at $1.48 per share compared to Q4 EPS of $1.05 a year ago. Fourth-quarter sales are anticipated to rise 11% to $52.41 billion.

Image Source: Zacks Investment Research

Annual earnings are expected to rise 13% in fiscal 2023 and leap another 14% in FY24 at $6.55 per share. On the top line, sales are forecasted to jump 12% this year and rise another 9% in FY24 to $222.15 billion. Making Cardinal’s stock more compelling is that shares of CAH trade at 14.1X forward earnings which is an attractive discount to the industry average of 20.7X and the S&P 500’s 20.9X.

Image Source: Zacks Investment Research

Alcon ALC

Also sporting a Zacks Rank #2 (Buy) Alcon’s stock is intriguing among the Zacks Medical-Instruments Industry which is in the top 41%.

The Zacks Medical-Instruments Industry contains a number of innovative companies such as Artivion AORT, Penumbra PEN, and iRadimed IRMD. Notably, Artivion, Penumbra, and iRadimed were able to beat their quarterly expectations earlier in the month and Alcon will be looking to do the same.

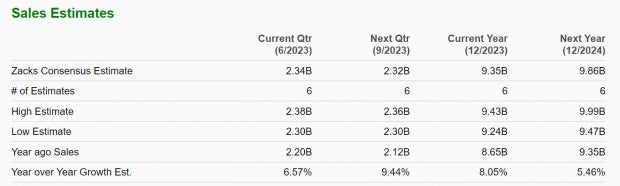

Alcon offers foreign exposure in the space as a Switzerland-based company that provides a full suite of eye care products. Intriguingly, Alcon is expecting steady annual top and bottom line growth despite its second-quarter earnings forecasted to dip -1% at $0.62 per share. Still, Q2 sales are forecasted to be up 6% to $2.34 billion.

Image Source: Zacks Investment Research

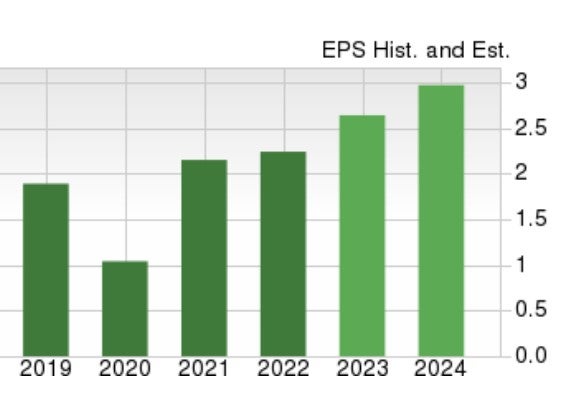

Plus, annual earnings are now projected to jump 18% in fiscal 2023 and climb another 15% in FY24 to $3.05 per share. Total sales are forecasted to be up 8% this year and rise another 5% in FY24 to $9.86 billion.

Image Source: Zacks Investment Research

Bottom Line

The outlook for Cardinal Health and Alcon is very attractive ahead of their quarterly reports on Tuesday. This is a good sign they may be able to offer positive or better-than-expected guidance which could help both of these medical stocks rally.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand-picked 7 your immediate attention.

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

iRadimed Corporation (IRMD) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Artivion, Inc. (AORT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.