Following Amazon’s (AMZN) impressive second-quarter results on Thursday, investing in e-commerce looks very intriguing right now.

Many Chinese e-commerce companies also look attractive with Alibaba (BABA) and JD.com (JD) standing out before their quarterly reports later in the month. Notably, the global e-commerce market is thought to be valued at upwards of $10 trillion dollars.

This makes investing among the major e-commerce players very lucrative as there is certainly potential for massive gains in the future. Although the compound annual growth rate (CAGR) for the global e-commerce market has naturally slowed it’s still estimated to be over 10%.

Furthermore, a 10% CAGR is attractive considering the size of some of the major e-commerce players like Alibaba and Amazon. Additionally, there are hidden gems in the global e-commerce market with now looking like a good time to invest in the space.

Image Source: Zacks Investment Research

Amazon’s Q2 Report

With inflation continuing to ease, Wall Street has been scoping out the growth and outlook for big tech companies during their quarterly reports and Amazon did not disappoint.

Amazon’s stock spiked after blasting Q2 earnings expectations on Thursday, highlighting that sales were boosted by strong demand for its diverse e-commerce products and record delivery times. Earnings of $0.63 per share impressively topped Q2 EPS estimates of $0.34 by 85% and soared 530% from earnings of $0.10 a share in Q2 2022.

Image Source: Zacks Investment Research

Surprising many analysts and delighting investors, Amazon appears to be prioritizing profits rather than expansion at the moment. To that point, Amazon’s net income for Q2 was a very impressive $6.7 billion compared to a loss of -$2 billion in the prior-year quarter.

Quarterly sales of $134.38 billion beat Q2 expectations by 2% and rose 11% from a year ago. Amazon’s dominance as an e-commerce provider has allowed the company to expand into other areas and It’s notable that Amazon Web Services (AWS) sales were up 12% with Advertising Services sales up 22%.

Amazon stock currently lands a Zacks Rank #3 (Hold) and a buy rating could be on the way with Q2 results reconfirming a strong earnings outlook. Annual earnings are now forecasted to skyrocket 118% in fiscal 2023 at $1.55 per share compared to $0.71 a share in 2022. Plus, FY24 earnings are expected to soar another 50% to $2.33 per share with it likely that EPS estimates will start to rise.

Image Source: Zacks Investment Research

Chinese E-Commerce

Alibaba and JD.com stock look attractive ahead of their quarterly reports on August 10 and 16 respectively.

Alibaba currently boasts a Zacks Rank #1 (Strong Buy) with JD’s stock sporting a Zacks Rank #2 (Buy). The earnings outlook for both of these Chinese e-commerce leaders is strengthening as logistics concerns subside following the reopening of China’s economy earlier in the year.

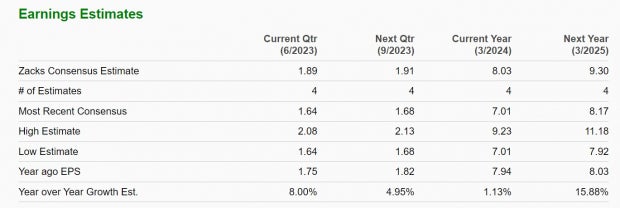

Alibaba’s fiscal first-quarter earnings are projected to rise 8% YoY to $1.89 per share with sales expected to be virtually flat at $30.79 billion. Annual earnings are expected to be up 1% in Alibaba’s current fiscal 2024 and climb another 16% in FY25 at $9.30 per share.

Image Source: Zacks Investment Research

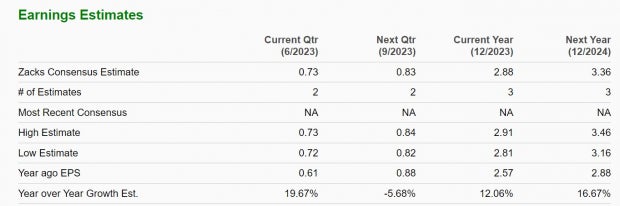

Pivoting to JD, its second-quarter earnings are anticipated to leap 19% YoY to $0.73 per share despite sales forecasted to dip -2% to $39.25 billion. Overall, JD’s fiscal 2023 earnings are expected to jump 12% with its bottom line projected to expand another 16% in FY24 at $3.36 per share.

Image Source: Zacks Investment Research

Hidden Gems

There are certainly e-commerce companies that are often overlooked for more popular names. On top of that, companies like United Parcel Service (UPS) are critical to transportation, deliveries, and broader logistic components.

UPS currently lands a Zacks Rank #3 (Hold) and will be a company to keep an eye on when it reports its second-quarter results next Tuesday, August 8.

eBay (EBAY) is also a viable option among e-commerce players and the company was able to beat its Q2 top and bottom line expectations in late July. eBay has a Zacks Rank #3 (Hold) and may reward patient investors with earnings expected to rise roughly 1% this year and jump another 9% in FY24 at $4.52 per share.

Bottom Line

It’s starting to look like an ideal time to invest in e-commerce companies. The outlook for many e-commerce players’ is strengthening and this should remain a viable space to invest in for 2023 and beyond.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.