Growing rumors that Tesla TSLA boss Elon Musk was visibly upset after the company missed its third quarter top and bottom-line expectations last Wednesday may have investors on edge about buying TSLA shares after the recent dip.

Tesla’s stock has dropped -12% since its Q3 report but is still up +72% for the year to largely outperform the broader market and many of its automaker peers including General Motors’ GM -13% and Ford’s F -1%.

Let’s see if the recent dip in Tesla’s stock is indeed a buying opportunity with the company still having a wide lead in the domestic EV market ahead of runner-ups General Motors and Ford.

Image Source: Zacks Investment Research

Q3 Review

Having a week to digest Tesla’s Q3 results has been critical for many investors with earnings coming in at $0.66 a share and -8% below the Zacks Consensus of $0.72 per share. On the top line, Q3 sales of $23.35 billion missed expectations by -4%.

Image Source: Zacks Investment Research

Strongly correlated to the recent dip in Tesla’s stock is that Q3 earnings fell -37% from EPS of $1.05 in the prior-year quarter. This was indicative of price cuts in the company’s EV lineup as Tesla has planned to prioritize affordability amid a challenging macroeconomic environment.

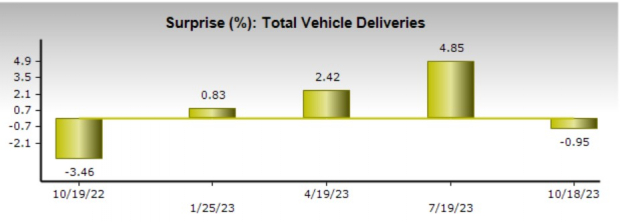

However, Q3 sales did rise 9% from a year ago with deliveries of 435,059 vehicles soaring 26% YoY despite missing Zacks estimates by roughly -1%.

Image Source: Zacks Investment Research

Growth & Valuation

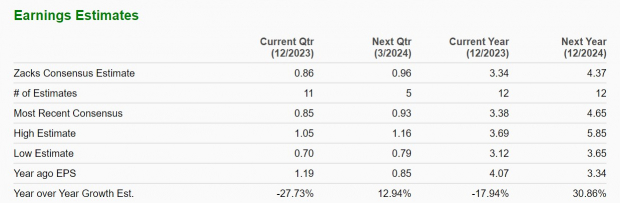

Tesla still expects to deliver 1.28 million vehicles this year and according to Zacks estimates earnings are now forecasted to dip -18% in fiscal 2023 at $3.34 a share but rebound and soar 31% in FY24 to $4.37 per share.

Being the clear-cut leader and innovator in its space, it’s important to note that TSLA trades at 63.5X forward earnings after last week’s selloff which is well below its extreme highs over the last five years and a 26% discount to the median of 86.3X.

Image Source: Zacks Investment Research

Total sales are forecasted to jump 21% this year and climb another 23% in FY24 to $121.78 billion. In regards to price to sales, TSLA has a P/S ratio of 6.8X which is still above the optimum level of less than 2X but nicely below its five-year high of 23.9X and the median of 8.1X.

Image Source: Zacks Investment Research

Takeaway

Following last week’s selloff, Tesla’s valuation has become more reasonable with TSLA shares currently landing a Zacks Rank #3 (Hold). While there could still be better buying opportunities ahead, Tesla’s outlook remains attractive and longer-term investors may certianly be rewarded for holding TSLA at current levels.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.