The optimism of higher travel demand has seemed to fade with many notable airline stocks falling sharply over the last few months.

Domestically, the three largest airlines by revenue Delta Air Lines DAL, American Airlines AAL, and United Airlines UAL have all seen their stocks fall of late after seeing 52-week highs in July.

With that being said, let’s see if the recent dip is a buying opportunity and what lies ahead for these leading airliners as they continue their post-pandemic recovery.

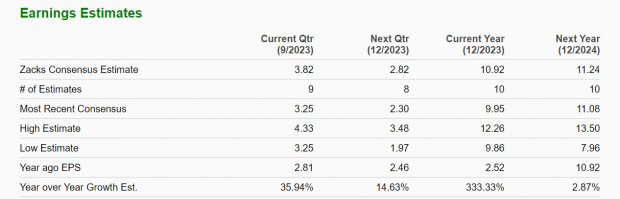

Image Source: Zacks Investment Research

Annual Growth Comparison

Premium Service

Delta which is considered a premium airliner for its above-average customer service and free flight changes operates a network of around 300 destinations in over 50 countries.

Delta’s annual earnings are now forecasted to soar 99% in fiscal 2023 at $6.36 a share versus EPS of $3.20 in 2022. Plus, fiscal 2024 earnings are projected to leap another 16%. On the top line, sales are expected to be up 11% this year and rise another 1% in FY24 to $56.82 billion.

Image Source: Zacks Investment Research

International Leader

Pivoting to United, the airline has the largest international exposure with over 130 destinations worldwide and 215 locations in the U.S. United’s earnings are anticipated to rebound and skyrocket 333% in fiscal 2023 to $10.92 per share compared to EPS of $2.52 last year. Fiscal 2024 earnings are expected to rise another 3%.Total sales are expected to jump 19% this year and rise another 6% in FY24 to $56.95 billion.

Image Source: Zacks Investment Research

Domestic Leader

Lastly, American has the largest domestic share in the market flying to around 350 locations domestically and more than 60 countries worldwide.

American’s earnings are now projected to rebound and catapult 476% to $2.88 per share compared to EPS of $0.50 a share in 2022. Fiscal 2024 earnings are forecasted to rise another 1%. Total sales are expected to rise 8% this year and edge up another 5% in FY24 to $55.66 billion.

Image Source: Zacks Investment Research

Valuation Comparison

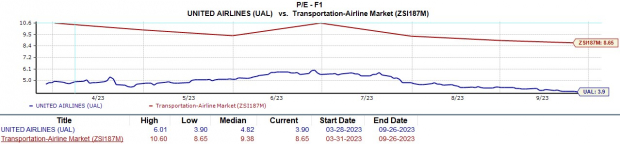

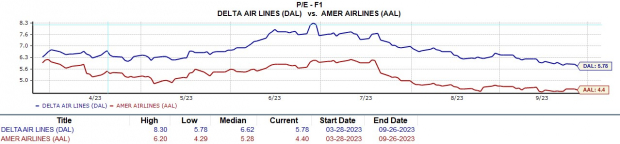

In addition to their attractive growth recovery, all three of the major airliners stand out in terms of price-to-earnings valuation and make the case for being undervalued in this regard.

United sticks out the most trading at just 3.9X forward earnings which is a 54% discount to the Zacks Transportation Airline Industry average of 8.6X and well below the S&P 500’s 20X.

Image Source: Zacks Investment Research

Furthermore, Delta and American also trade at attractive discounts to the industry and benchmark trading at 5.7X and 4.4X forward earnings respectively.

Image Source: Zacks Investment Research

Bottom Line

At the moment all three of the big airline stocks land a Zacks Rank #3 (Hold). There could be more short term risk associated with broader market volatility and the resurgence of inflationary pressures on travel.

However, Delta, United, and American Airlines stock are making a strong case for being undervalued at their current levels, and holding on to them should be rewarding as they offer various exposure to domestic and international markets.

Just Released: Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for 2023?

From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%. Our Director of Research has now combed through 4,000 companies covered by the Zacks Rank and handpicked the best 10 tickers to buy and hold in 2023. Don’t miss your chance to still be among the first to get in on these just-released stocks.

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.