It’s been a volatile year for Block (SQ) and PayPal’s (PYPL) stock with both of these fintech innovators hitting 52-week lows during the third quarter but posting strong Q3 results this week.

Soaring more than +20% this morning, Block’s stock ended today’s trading session up +10% after strong Q3 results on Thursday while PayPal’s stock was up roughly +2% and has risen +8% since its favorable quarterly report on Wednesday.

With both companies surpassing top and bottom line expectations, investors may be wondering if it’s time to buy stock in these popular payment solution providers for a continued rebound.

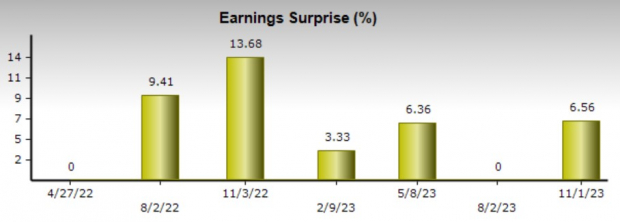

Image Source: Zacks Investment Research

Q3 Review & Highlights

Amid higher inflation fears of slower growth and increasing competition have been the knock-on Block and PayPal’s stock in 2023 despite being Wall Street darlings in years past.

Still, stronger-than-expected Q3 results are starting to make the cautionary tale in their stocks look overdone with SQ and PYPL both down just over -20% YTD despite this week’s rally.

Block Q3 Review: Driven by increasing demand for cash app and its Square payment processing products, Block’s Q3 earnings of $0.55 per share crushed the Zacks Consensus of $0.44 a share by 25%. On the top line, sales of $5.62 billion beat Q3 estimates by 4%.

More importantly, Q3 earnings soared 31% year over year with sales rising 24% from the prior-year quarter. Block also raised its full-year guidance in some key areas now expecting adjusted EBITDA in the range of $1.66 billion-$1.68 billion and up from previous estimates of $1.5 billion. Even better, Block projects its full-year operating income to be between $205-$225 million soaring from previous guidance of $25 million while expecting gross profit at $7.44 billion-$7.46 billion.

Image Source: Zacks Investment Research

PayPal Q3 Review: Somewhat quieting growth concerns, PayPal’s Q3 earnings of $1.30 per share beat estimates of $1.22 a share by 6% with sales of $7.41 billion coming in slightly above expectations of $7.39 billion. Furthermore, PayPal’s earnings soared 20% from EPS of $1.08 a share in the prior year quarter while sales rose 8% from $6.84 billion in Q3 2022.

Although there was a lot to like about PayPal’s Q3 results including international revenue increasing 10% YoY the company’s key guidance for earnings of $1.36 per share during the fourth quarter is below many analysts’ estimates with the Zacks Consensus having Q4 EPS at $1.41 a share.

Image Source: Zacks Investment Research

Takeaway

Considering the very impressive earning beat and strong guidance, Block’s stock currently sports a Zacks Rank #2 (Buy) with PayPal’s stock landing a Zacks Rank #3 (Hold). The potential for a continued rebound in these fintech stocks is gaining steam with Block shares making a stronger case for more upside at the moment.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.