The tech sector has largely attributed to the broader year-over-year growth in this year’s Q4 earnings season with internet software player Twilio (TWLO) adding to this correspondence after market hours on Wednesday.

Despite showcasing expansive quarterly growth and continuing a very impressive streak of exceeding bottom line expectations, Twilio’s stock dropped -15% in Thursday’s trading session on softer guidance.

With that being said, let’s see if the post-earnings dip is a buying opportunity or if investors should be cautious at the moment.

Image Source: Zacks Investment Research

Strong Q4 Earnings

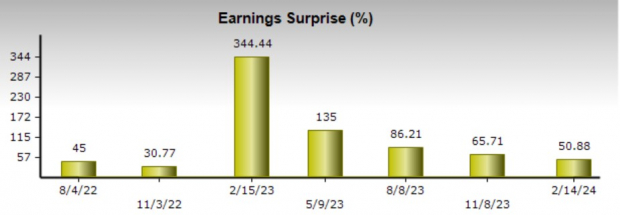

Twilio’s programmable communication tools have been in higher demand with the customer engagement company topping the Zacks EPS consensus for 20 consecutive quarters. Fourth quarter earnings of $0.86 a share crushed estimates of $0.57 a share by 51%. Magnifying Twilio’s consistency has been its growth as Q4 earnings skyrocketed 290% from $0.22 per share a year ago. Plus, Q4 sales of $1.07 billion topped estimates by 3% and rose 5% YoY.

Image Source: Zacks Investment Research

Soft Sales Guidance

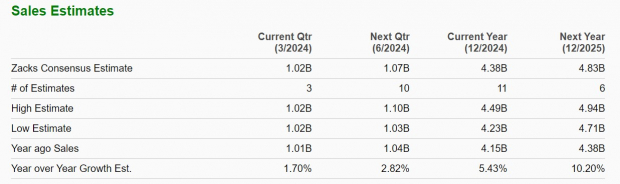

Twilio’s total sales increased 9% in fiscal 2023 to $4.15 billion but weaker revenue guidance for the first quarter caused TWLO shares to drop unlike internet software peer BlackLine BL who topped its quarterly estimates on Tuesday and saw its stock spike over 2% yesterday.

Twilio’s long-term prospects are still resiliently favorable but Wall Street was underwhelmed with the company’s forecasts of roughly $1.02-$1.03 billion in sales for Q1 or 2-3% revenue growth. However, the lower end of Twilio’s revenue guidance does match the Zacks Consensus with Twilio’s total sales projected to rise 5% in FY24 and expand another 10% next year to $4.83 billion.

Image Source: Zacks Investment Research

EPS Outlook and Revisions

Garnishing more investors’ attention and promising to shareholders was Twilio’s annual EPS of $2.45 per share in FY23 compared to an adjusted loss of -$4.44 a share in 2022. Earnings are currently forecasted to dip -3% this year but rebound and climb 23% in FY25 to $2.93 per share based on Zacks estimates.

More importantly, earnings estimate revisions are slightly up over the last 60 days for both FY24 and FY25.

Image Source: Zacks Investment Research

Bottom Line

For now, Twilio’s stock currently sports a Zacks Rank #2 (Buy) as the cloud communication providers growth potential is still compelling. However, retaining its buy rating will largely depend on the trend of earnings estimate revisions in the coming weeks.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Twilio Inc. (TWLO) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.