One area of the economy to look for growth at the moment is the outdoor dining space with the Zacks Retail-Restaurants Industry currently in the top 19% of over 250 Zacks industries.

The post-pandemic recovery of outdoor dining is in full swing as many restaurants and fast food chains should be primary beneficiaries of easing inflation as well. With that being said, here are several highly ranked Zacks Retail-Restaurants stocks to consider right now.

Brinker International EAT

We’ll start with Brinker International which operates and franchises two popular restaurant chains in Chile’s Grill & Bar (Chile’s) and Maggiano’s Little Italy (Maggiano’s). Illustrating the strengthening industry outlook, Brinker International was able to crush its fiscal first quarter top and bottom line expectations earlier in the month.

First quarter earnings of $0.28 per share easily surpassed estimates of $0.03 a share and reassuringly soared from an adjusted loss of -$0.57 a share in the prior-year quarter. Quarterly sales of $1.01 billion slightly surpassed estimates of $1 billion and rose 6% year over year.

Image Source: Zacks Investment Research

Starting to put inflationary fears behind it, Brinker International’s annual earnings are now forecasted to climb 26% in its current fiscal 2024 to $3.57 per share compared to EPS of $2.83 a share last year. Plus, FY25 EPS is projected to rise another 9% and Brinker International shares trade at an attractive 9.9X forward earnings multiple which is a noticeable discount to the industry average of 25.4X and the S&P 500’s 21.4X.

Image Source: Zacks Investment Research

Carrols Restaurant Group TAST

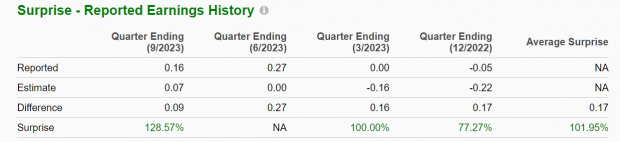

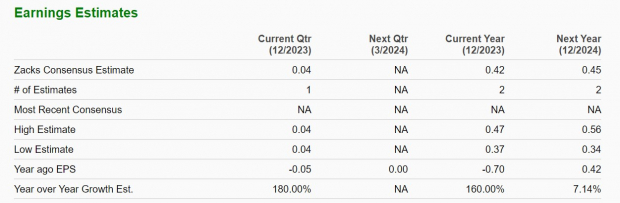

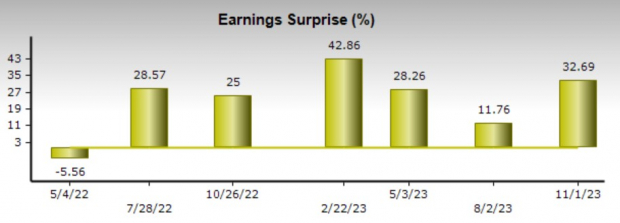

Carrols Restaurant Group’s stock is also worthy of consideration as the largest Burger King franchisee in the U.S. with over 800 restaurants. The company’s third quarter results in early November helped reconfirm this as well.

Third quarter earnings of $0.16 a share more than doubled Q3 estimates of $0.07 a share and soared from an adjusted loss of -$0.14 per share a year ago. Furthermore, Q3 sales of $475.76 million rose 7% YoY despite slightly missing estimates of $476.38 million.

Image Source: Zacks Investment Research

Still, Carrol Group’s stock looks intriguing with the company expected to post an annual profit of $0.42 per share in 2023 compared to an adjusted loss of -$0.70 a share last year. Fiscal 2024 earnings are expected to rise another 7% to $0.45 a share. Even better, Carrol Group’s stock trades at $7 a share and 18.2X forward earnings which is nicely beneath the industry average and the benchmark.

Image Source: Zacks Investment Research

Wingstop WING

Another popular restaurant among franchisees is Wingstop and the chicken wings-focused food chain did not disappoint with its Q3 results coming in much better than expected earlier in the month.

Notably, Wingstop operates through two segments, its Franchise segment and its Company segment with Q3 earnings of $0.69 per share beating expectations of $0.52 a share by 32% and climbing from $0.45 a share in the prior-year quarter. Quarterly sales of $117.10 million also topped Q3 estimates by 7% and soared 26% from $92.67 million a year ago.

Image Source: Zacks Investment Research

Wingstop’s annual EPS growth is especially attractive with FY23 earnings now projected to leap 29% to $2.39 per share versus $1.85 a share in 2022. More impressive, FY24 earnings are forecasted to climb another 17% to $2.80 per share.

Image Source: Zacks Investment Research

Takeaway

At the moment, Brinker International, Carrols Restaurant Group, and Wingstop’s stock all boast a Zacks Rank #1 (Strong Buy). In addition to this, these highly ranked Zacks Retail-Restaurants stocks also land an “A” Zacks Style Scores grade for Growth with now looking like an ideal time to buy.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Carrols Restaurant Group, Inc. (TAST) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.