After providing underwhelming guidance during their Q2 reports in August, Target TGT and Dollar Tree’s DLTR stock have continued to move lower.

Both retail giants are hovering near their 52-week lows with Target’s stock down -17% for the year and Dollar Tree shares falling -19%.

Naturally, investors may be wondering if now is a buying opportunity. Let’s take a look at Target and Dollar Tree’s outlook to gauge a rebound.

Image Source: Zacks Investment Research

Sustaining Growth

As retail giants, Target and Dollar Tree are vying to sustain their growth amid a more challenging operating environment.

Lower margins are affecting both companies with fears surrounding sales mix and high theft at the center of attention.

Dollar Tree’s low-priced consumer products already call for lower margins on top of the impact of shrink although the trend in consumer shopping has still focused on savings which has weighed down Target’s margins as a higher-quality retailer.

Although EPS estimates have trended down over the last 30 days in correlation with lowered guidance, Target’s bottom line is still expected to expand 26% in its current fiscal 2024 with earnings projected to jump another 18% in FY25 at $9.01 per share.

Image Source: Zacks Investment Research

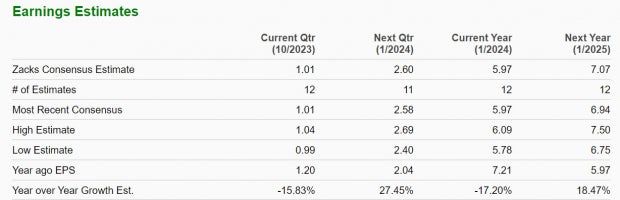

Pivoting to Dollar Tree, earnings are now expected to decline -17% in its FY24 but stabilize and rebound 18% in FY25 at $7.07 per share. However, Dollar Tree’s FY23 and FY24 EPS estimates are slightly down over the last month as well.

Image Source: Zacks Investment Research

Undervalued Case

Declining earnings estimates are concerning but Target and Dollar Tree’s low P/E valuations bid well for more upside in their stocks from current levels.

Trading around $122 a share, Target’s stock trades at a 16.1X forward earnings multiple. This is nicely beneath its Zacks Retail-Discount Stores industry average of 22.6X and the S&P 500’s 26.2X.

Furthermore, Target’s stock trades at a 47% discount to its decade-long high of 30.4X and slightly beneath the median of 16.3X.

Image Source: Zacks Investment Research

At $114 and 19.4X forward earnings, Dollar Tree’s stock also trades nicely beneath the Retail-Discount Stores industry average and the benchmark. Notably, Dollar Tree’s stock trades 41% below its own decade-long high of 32.5X and on par with the median of 19.7X.

Image Source: Zacks Investment Research

Takeaway

Given that earnings estimates don’t keep skidding from here, Target and Dollar Tree’s stock may certainly have more upside as they appear to be undervalued relative to their industry and the broader market. This lands both Target and Dollar Tree stock a Zacks Rank #3 (Hold) as a rebound is starting to look plausible from their current levels.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Target Corporation (TGT) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.