Home Depot’s HD better-than-expected second-quarter results this morning was a bright spot among retailers.

With Home Depot able to surpass top and bottom line expectations Ross Stores ROST and TJX Companies TJX are two retailers to watch as well. This is especially true with the back-to-school shopping season upon us.

Keeping this scenario in mind, now may be a good time to buy TJX and Ross stock as their Q2 reports approach on August 16 and 17 respectively.

TJX Q2 Preview: As a global leader among off-price apparel retailers, TJX’s Q2 report could bring good news to investors’ ears.

TJX’s Q2 earnings are expected to be up 10% at $0.76 per share with sales anticipated to rise 5% to $12.41 billion. Notably, the Zacks Expected Surprise Prediction (ESP) has TJX beating earnings expectations with the Most Accurate Estimate having Q2 EPS at $0.78 and 2% above the Zacks Consensus.

There would be no surprise if TJX accompanies its Q2 results with favorable guidance as the company’s top and bottom lines are expected to expand 6% and 10% during the third-quarter respectively.

Image Source: Zacks Investment Research

Ross Q2 Preview: Ross Stores has carved out its own niche as an off price-retailer of clothing and other apparel and the company’s outlook has strengthened as back-to-school shopping begins.

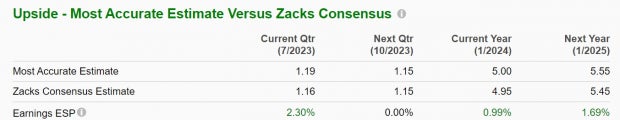

While the third-quarter should be a particularly strong period for Ross, respectable growth is expected in the company’s Q2 results on Thursday as well. Earnings are expected to rise 4% at $1.16 per share with Q2 sales projected to be up 3% to $4.73 billion. Plus, the Zacks ESP also indicates Ross could surpass earnings expectations with the Most Accurate Estimate having Q2 EPS at $1.19 and 2% above the Zacks Consensus.

Looking ahead there is a strong chance Ross will be able to offer favorable guidance with the company projected to have 15% earnings growth during Q3 and its top line forecasted to expand 2% from the prior-year quarter.

Image Source: Zacks Investment Research

Takeaway

With TJX stock only up +8% this year and Ross shares down -2% these off-price retail apparel leaders appear to be overlooked at the moment. Ross and TJX stock currently sport a Zacks Rank #2 (Buy) as the back-to-school shopping season should give them a nice boost and annual earnings estimates have trended higher.

Furthermore, both companies are expected to beat Q2 earnings expectations and strong quarterly results and positive guidance could start to reconfirm the anticipation of double-digit percentage growth on Ross and TJX’s bottom line in fiscal 2023 and FY24.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.