Shares of Intel INTC spiked +6% today following the world’s largest semiconductor company’s stronger-than-expected second-quarter results on Thursday evening.

The news is giving many chip stocks a boost with rival Advanced Micro Devices AMD set to report Q2 earnings next Tuesday, August 1.

Let’s see if now is a good time to buy Intel or AMD stock this earnings season as the broader slowdown for chip stocks ends with the semiconductor realm boosted by artificial intelligence (AI).

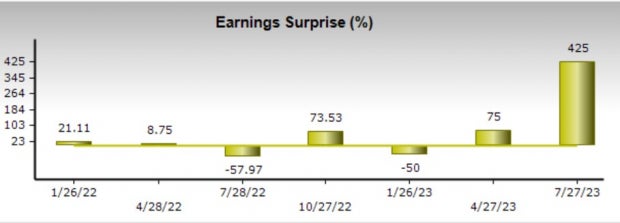

Image Source: Zacks Investment Research

Intel Q2 Review

Optimistically, Intel crushed Q2 earnings expectations at $0.13 per share compared to estimates that called for an adjusted loss of -$0.04 a share. This is surely seen as a step in the right direction with hopes that Intel can eventually put its string of quarterly earnings and revenue declines behind it.

In regards to the quarterly declines, Q2 earnings were still down -55% YoY with sales down -15% to $12.94 billion but this reassuringly beat top-line estimates by 7%.

Image Source: Zacks Investment Research

Intel CEO Pat Gelsinger stated the slowdown in chip demand has ended and the company is well-positioned to capitalize on the significant growth across the AI continuum.

Specifically, Gelsinger stated Intel is championing an open ecosystem and silicon solutions that optimize performance, cost, and security to democratize AI from cloud to enterprise, edge and client. More importantly, the company believes its turnaround is upon us after losing much of its dominance to AMD and Nvidia NVDA over the years.

AMD Q2 Preview

Set to report its Q2 results next Tuesday, Wall Street will be checking the developments of AMD’s more advanced graphics processing unit (GPU) for AI, the MI300X. This is thought to be Nvidia’s strongest challenger in the market and could help AMD expand.

With that being said, AMD is up against a tougher to compete against quarter. Second-quarter earnings are expected to drop -46% to $0.57 per share compared to EPS of $1.05 in Q2 2022. On the top line, Q2 sales are forecasted to dip -19% to $5.32 billion. AMD most recently beat its Q1 earnings expectations by 7% in May and surpassed top-line estimates by 1%.

Image Source: Zacks Investment Research

Takeaway

At the moment Intel stock lands a Zacks Rank #2 (Buy) primarily attributed to rising earnings estimate revisions which should continue following the company’s stronger-than-expected Q2 results.

As for AMD, earnings estimates are slightly down with the stock landing a Zacks Rank #3 (Hold) but surpassing expectations next week could reverse the trend and be a further catalyst to the rally among chip stocks this year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand-picked 7 your immediate attention.

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.