News of a potential mega-merger between Cigna (CI) and Humana (HUM) made headlines in today’s trading session.

As the two largest health insurers in the U.S., the merger would create a dominant alliance and investors may be wondering if now is a good time to buy stock in these health giants.

Performance Overview

As they stand alone, Cigna and Humana both have a dominant share of the medical insurance plan market offering HMOs, PPOs, and Private Fee-For-Service (PFFS) plans. Talks of a potential merger via a stock and cash deal saw Cigna’s stock fall -8% on Wednesday while Humana shares fell -5%.

However, the deal could create a revenue pipeline that would be rivaled by few mergers or acquisitions in any industry and Cigna’s stock is up +26% over the last three years while Humana shares have risen +20% with both near the S&P 500’s performance and topping the Nasdaq’s +17%.

More impressive is that over the last decade, Humana’s stock has soared +364% to top the broader indexes while Cigna’s +204% has topped the benchmark’s +160% and is on the heels of the Nasdaq’s +251%.

Image Source: Zacks Investment Research

Growth & Outlook

The top and bottom line expansion of Humana and Cigna has been remarkable and is why a potential merger could be very enticing for investors. Notably, both stocks have an “A” Zacks Style Scores grade for Growth.

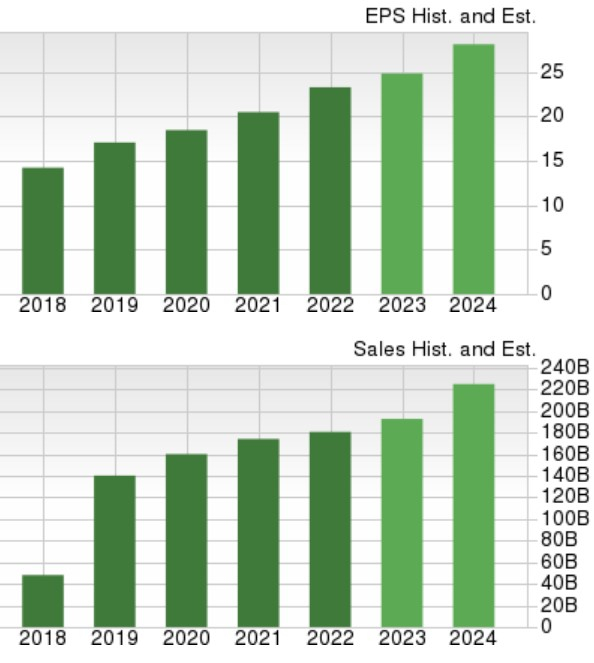

To that point, Cigna’s annual earnings are now expected to rise 6% in fiscal 2023 and jump another 14% in FY24 to $28.23 per share. On the top line, sales are projected to be up 7% this year and climb another 18% in FY24 to $227.64 billion.

Image Source: Zacks Investment Research

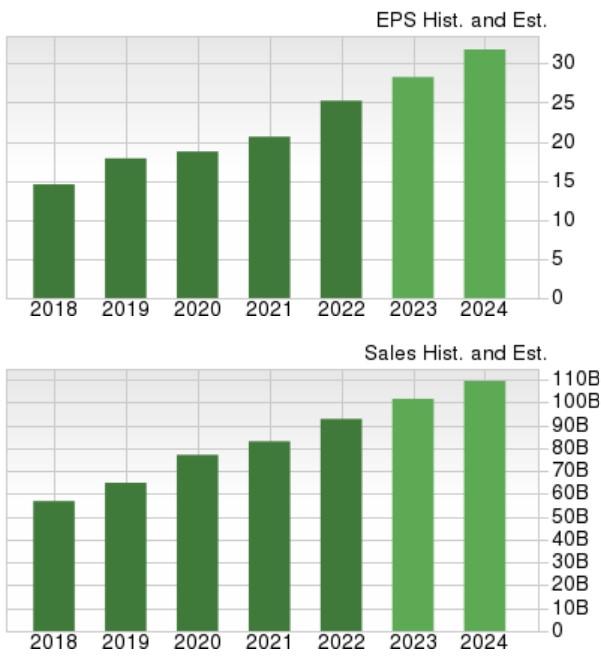

Pivoting to Humana, annual earnings are forecasted to jump 12% in FY23 and climb another 11% in FY24 at $31.42 per share. Total sales are expected to rise 10% in FY23 and expand another 9% next year to $111.94 billion.

Image Source: Zacks Investment Research

Bottom Line

Given their attractive outlooks, a potential Cigna and Humana merger would be very compelling for longer-term investors. For now, both stocks land a Zacks Rank #3 (Hold) as better buying opportunities could be ahead but their growth and expansion is hard to overlook even without a potential merger.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Humana Inc. (HUM) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.