Finance and insurance conglomerate Berkshire Hathaway (BRK.B) will round out this week’s earnings lineup in a shortened week of trading.

Still, there is much anticipation for the renowned holding company’s fourth-quarter earnings report on Friday, February 24.

Sentiment

Trading at $303, BRK.B shares are only 16% from their 52-week highs but investors are anxious as there hasn’t been overwhelming momentum for the stock or other well-known financial conglomerates such as BlackRock (BLK) and Goldman Sachs (GS) to start the new year.

On that note, only Goldman Sachs’ year-to-date performance has topped the S&P 500 with Berkshire and BlackRock trailing the broader market. However, Berkshire’s stock does carry a “B” Style Scores grade for Momentum going into its Q4 report and strong results could be a significant catalyst for the stock.

Image Source: Zacks Investment Research

Q4 Preview & Outlook

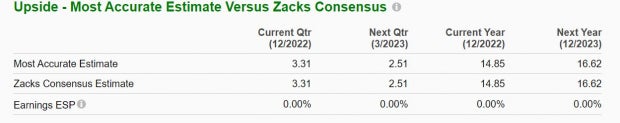

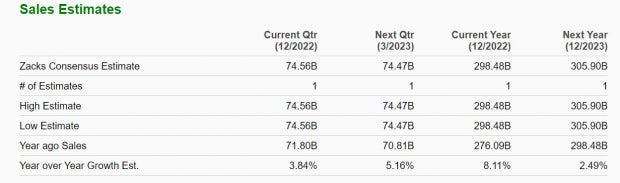

Berkshire’s Q4 earnings are projected at $3.31 per share, which would be up 1% year over year. The Zacks Surprise Prediction indicates Berkshire should reach quarterly expectations on its bottom line with the Most Accurate Estimate also having Q4 EPS at $3.31 a share. Sales for the quarter are expected to be $74.56 billion, up 4% from the prior year quarter.

Image Source: Zacks Investment Research

Rounding out Berkshire’s fiscal 2022 earnings are now forecasted to climb 22% to $14.85 a share compared to EPS of $12.12 in 2021. Earnings are expected to rise another 12% in FY23 to $16.62 a share.

Earnings estimate revisions have remained the same throughout the quarter. On the top line, sales are now forecasted to be up 8% for FY22 and rise another 2% in FY23 at $305.90 billion.

Image Source: Zacks Investment Research

Performance & Valuation

Despite its lackluster year-to-date performance, Berkshire stock has held up better than the broader market over the last year. Berkshire is only down -2% in the last 12 months to top the S&P 500’s -6%, and BlackRock’s -7% but trail Goldman Sachs +6%.

Even better, over the last decade, Berkshires +197% has topped Blackrock, Goldman Sachs, and the benchmark.

Image Source: Zacks Investment Research

At its current levels, BRK.B trades at 18.2X forward earnings which is above the industry average of 13.5X but Berkshire is an industry leader. Plus, Berkshire’s stock trades 40% below its decade-long high of 30.4X and at a 10% discount to the median of 20.3X.

Image Source: Zacks Investment Research

Bottom Line

Berkshire Hathaway’s (BRK.B) stock currently lands a Zacks Rank #3 (Hold) going into its Q4 report. Holding on to shares of BRK.B at their current levels could be rewarding with the stock trading attractively relative to its past from a valuation standpoint.

With that being said, much of the upside potential in BRK.B stock largely depends on Berkshire illustrating its bottom line will remain robust in correlation with positive guidance.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.