The Zacks Consumer Staples sector has held up relatively well in 2022, down roughly 2% and widely outperforming the S&P 500.

Consumer Staples stocks can generate revenue in all economic situations thanks to consistent product demand, explaining why the sector has performed better than most YTD.

A big-time company residing in the realm, Campbell Soup CPB, is seeing its shares march toward 52-week highs, undoubtedly a major positive.

As we can see in the chart below, CPB shares have widely outperformed the general market in 2022.

Image Source: Zacks Investment Research

In addition, the company has seen its near-term earnings outlook improve over the last several months, helping land it into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Stocks making new highs tend to make even higher highs, especially when positive earnings estimate revisions roll in from analysts.

How does the company currently stack up? Let’s take a closer look.

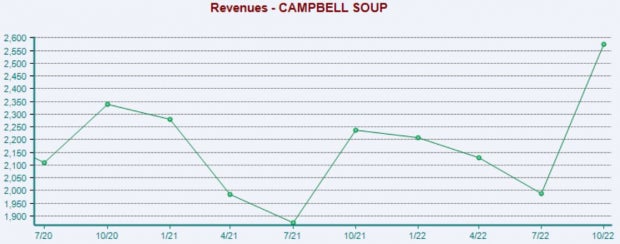

Quarterly Performance

CPB has consistently posted better-than-expected results, exceeding the Zacks Consensus EPS Estimate in eight of its last ten quarters.

Just in its latest release, Campbell Soup penciled in a 19% bottom-line beat paired with a 6% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

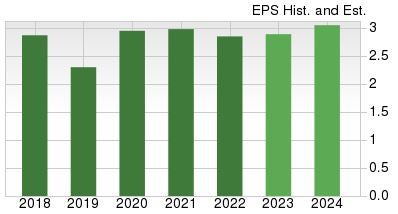

Growth Outlook

In addition, the company has a favorable growth profile for a mature company; earnings are forecasted to climb 4.6% on 8.3% higher revenues in its current fiscal year (FY23).

And in FY24, the company’s bottom line is forecasted to expand a further 5.6% on top of a marginal pullback in revenue.

Image Source: Zacks Investment Research

Dividends

Who doesn’t like to get paid?

For those with an appetite for income, CPB has that covered; the company’s annual dividend currently yields a solid 2.6%, just a tick below its Zacks Consumer Staples sector average.

Further, Campbell Soup has a sustainable payout ratio sitting at 50% of its earnings.

Image Source: Zacks Investment Research

Bottom Line

Consumer Staples stocks have been relatively strong in 2022, providing investors with a much-needed blend of defense.

These companies generate reliable demand in the face of many economic backdrops thanks to their essential products.

Campbell Soup CPB, a company residing in the space, has seen its shares inch toward 52-week highs on the back of an improved earnings outlook.

For those looking for more strong stocks from the Zacks Consumer Staples sector, Archer Daniels Midland ADM could also be considered.

Archer Daniels Midland is one of the leading producers of food and beverage ingredients and goods made from various agricultural products.

ADM’s near-term earnings outlook has turned visibly bright over the last several months, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.