Caterpillar CAT, the world’s largest construction-equipment manufacturer, has seen its earnings outlook turn visibly bright over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Undoubtedly a major positive, shares are heading toward all-time highs.

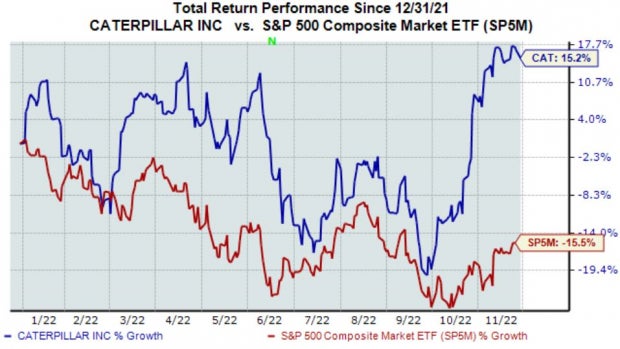

Caterpillar shares have already been a bright spot in an otherwise dim market year-to-date, up more than 15% and widely outperforming the S&P 500.

Image Source: Zacks Investment Research

It raises a valid question: how does the company currently stack up?

Let’s take a closer look.

Valuation

The company’s shares currently trade at a 17.1X forward earnings multiple, modestly above its 16.4X five-year median and a few ticks below its Zacks Industrial Products sector average.

Image Source: Zacks Investment Research

Further, the company’s price-to-book ratio currently stands at 7.8X, above the 5.9X five-year median and Zacks sector average.

Image Source: Zacks Investment Research

CAT sports a Value Style Score of a B.

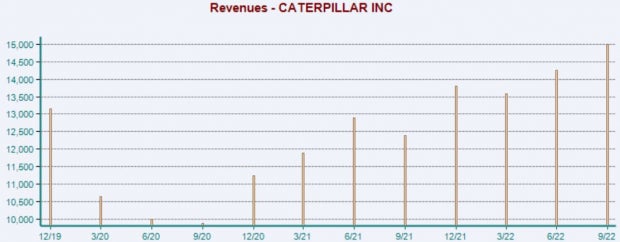

Growth Outlook & Quarterly Performance

Caterpillar has a strong growth profile, with earnings and revenue forecasted to soar 28% and 14.4% in FY22, respectively.

In addition, the company has been on a strong earnings streak, exceeding the Zacks Consensus EPS Estimate in ten consecutive quarters. Just in its latest release, the company registered a 24% bottom-line beat paired with a 4.5% sales surprise.

Image Source: Zacks Investment Research

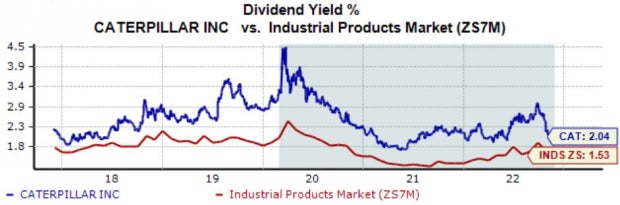

Consistent Dividends

For the cherry on top, Caterpillar is a Dividend Aristocrat; 2022 marked the company’s 29th consecutive year of increased dividend payouts.

Caterpillar’s annual dividend currently yields 2% paired with a solid 9% five-year annualized dividend growth rate. As we can see, the company’s current yield is modestly higher than its Zacks sector average.

Image Source: Zacks Investment Research

Bottom Line

Stocks making new highs tend to make even higher highs, especially when positive earnings estimate revisions have rolled in from analysts.

As it stands, Caterpillar CAT shares are heading toward all-time highs, undoubtedly a major positive that tells us that positive momentum is present.

And with a strong earnings outlook, shares have the fuel they need to potentially continue on their run.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Caterpillar Inc. (CAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.