As we begin the third quarter and progress through 2023 many stocks in the Zacks Retail-Restaurants Industry may be able to feed investors’ growing appetite for more stock gains with the S&P 500 now up +17% this year and the Nasdaq soaring +31%.

Notably, the Zacks Retail-Restaurants Industry is currently in the top 10% of over 250 Zacks industries and is host to an abundance of highly-ranked stocks that should have more upside as inflation continues to ease and consumers spend more on dining out.

Here is a look at three stocks in the space that are sporting a Zacks Rank #1 (Strong Buy) and could move higher during Q3.

Dave & Buster’s (PLAY): As a leading owner and operator of high-volume venues in North America that combine dining and entertainment for both adults and families, Dave & Buster’s post-pandemic growth remains attractive.

Dave & Buster’s earnings are now forecasted to climb 27% in its current fiscal 2024 and jump another 22% in FY25 at $4.35 per share. More intriguing, Dave & Buster’s stock trades at $43 a share and just 12.1X forward earnings which is a considerable discount to the industry average of 24.2X and nicely beneath the S&P 500’s 20.6X.

Image Source: Zacks Investment Research

BJ’s Restaurants (BJRI): Another intriguing option among the Zacks Retail-Restaurants Industry is the high-end casual dining chain BJ’s Restaurants with the company’s post-pandemic recovery gaining steam as well.

With BJ’s stock trading at $30, earnings are projected to skyrocket 312% this year at $0.70 per share compared to EPS of $0.17 in 2022. Plus, fiscal 2024 earnings are expected to soar another 65% to $1.16 per share.

More importantly, earnings estimates have remained higher with FY23 EPS estimates rising 23% over the last quarter and FY24 estimates up 3%.

Image Source: Zacks Investment Research

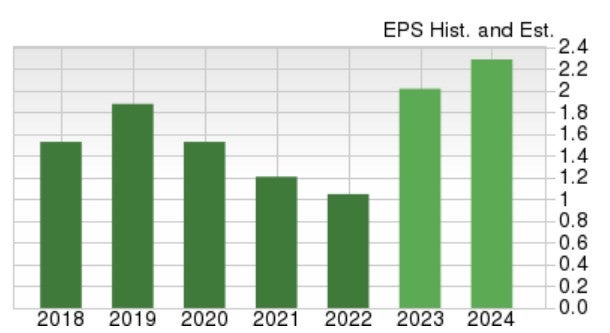

Yum China (YUMC): Offering exposure to the reopening of the Chinese economy is Yum China which operates KFC’s, Pizza Hut’s, and Taco Bell’s among other restaurants in the People’s Republic.

With Yum China stock trading at $54 a share, the company is expected to eclipse pre-pandemic earnings of $1.88 per share in 2019.

To that point, Yum China’s earnings are now projected to soar 89% in fiscal 2023 at $1.99 per share compared to EPS of $1.05 in 2022. Even better, FY24 earnings are forecasted to leap another 21% at $2.41 per share.

Image Source: Zacks Investment Research

Bottom Line

Easing inflation is starting to strengthen the outlook for many Zacks Retail-Restaurants stocks and they could outperform the broader market with rising earnings estimates serving as a strong catalyst for more upside.

Other options to consider among the top-rated Retail-Restaurants Industry include Shake Shack (SHAK) and Potbelly (PBPB) which also sport a Zacks Rank #1 (Strong Buy).

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand-picked 7 your immediate attention.

BJ’s Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Dave & Buster’s Entertainment, Inc. (PLAY) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.