We see analyst upgrades and downgrades daily, commonly coming paired with updated price targets. They can be helpful tools for investors, providing a more structured plan and helping to inject positivity surrounding future performance.

Of course, stocks don’t straightforwardly reach price targets, as unforeseen circumstances can always influence performance. Overall, the shift in sentiment can be seen as a primary takeaway from these upgrades.

And recently, three stocks – Netflix NFLX, Emerson Electric EMR, and Discover Financial Services DFS – have all seen recent upgrades among analysts. Let’s take a closer look at each.

Netflix

Loop Capital upgraded NFLX shares to buy from hold with a new $500 per share price target. The company has enjoyed positive earnings estimate revisions across several timeframes, as shown below.

Image Source: Zacks Investment Research

The company posted somewhat mixed quarterly results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 15% and modestly falling short of revenue expectations. Still, the company easily surpassed Subscriber Adds expectations, the most critical metric for the streaming titan.

Netflix’s revenue growth has been remarkable but has slightly cooled in recent quarters, as we can see below.

Image Source: Zacks Investment Research

Emerson Electric

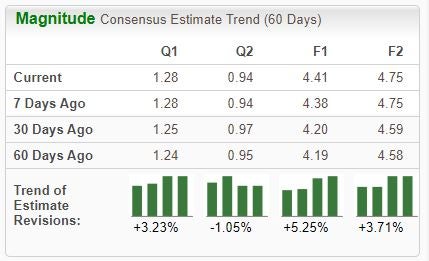

JPMorgan recently upgraded EMR shares to Overweight from Neutral with an updated $107 per share price target. Like NFLX, Emerson Electric has seen its near-term earnings outlook shift positively across nearly all timeframes.

Image Source: Zacks Investment Research

For those with a preference for income, EMR shares have that covered; shares currently yield 2.1% annually paired with a sustainable payout ratio sitting at 44% of the company’s earnings. Dividend growth is there, too, with the payout growing by a modest 1.5% annualized over the last five years.

Image Source: Zacks Investment Research

Discover Financial Services

Wolfe Research recently upgraded DFS shares to Outperform from Peerperform with a new $104 per share price target.

Value-focused investors could likely be attracted to DFS shares, further reflected by its Style Score of “A” for Value. Shares currently trade at a 6.8X forward earnings multiple, nicely beneath the 8.6X five-year median and highs of 9.6X in 2022.

Image Source: Zacks Investment Research

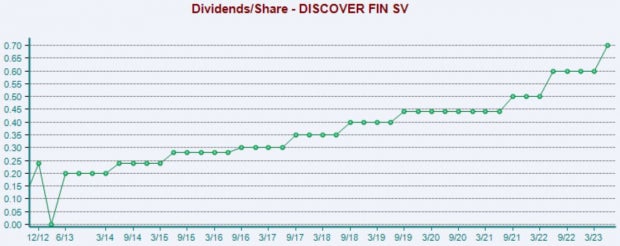

Like EMR, DFS rewards its shareholders nicely; shares currently yield a sizable 3.2% paired with an 11% five-year annualized dividend growth rate. As we can see below, the company has a long history of increasingly rewarding shareholders.

Image Source: Zacks Investment Research

Bottom Line

Price targets can be helpful tools. Of course, it’s critical to note that not all stocks reach these forecasted levels, as unforeseen circumstances can always affect future performance.

Still, the positivity surrounding upgrades can be seen as a solid takeaway.

All three stocks above – Netflix NFLX, Emerson Electric EMR, and Discover Financial Services DFS – have all seen recent upgrades among analysts.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Discover Financial Services (DFS) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.