We see analyst upgrades and downgrades daily, commonly coming paired with updated price targets. They can be helpful tools for investors, providing a more structured plan and helping to inject positivity surrounding future performance.

Of course, stocks don’t straightforwardly reach price targets, as unforeseen circumstances can always influence performance. Overall, the shift in sentiment can be seen as a primary takeaway from these upgrades.

Recently, three stocks – Micron MU, Carvana CVNA, and First Solar FSLR – have all gotten favorable upgrades from analysts. Let’s take a closer look at each.

Micron

Micron manufactures and markets high-performance memory and storage technologies, including Dynamic Random Access Memory (DRAM), NAND flash memory, NOR Flash, 3D XPoint memory, and other technologies. Deutsche Bank upgraded MU shares to Buy from Hold, with an $85 per share price target.

The company’s latest quarterly results came in nicely above expectations, snapping a streak of negative surprises. Micron posted a 10% EPS beat and posted revenue 2% ahead of expectations.

Income-focused investors could be attracted to MU shares, currently yielding a respectable 0.7% annually paired with a sustainable payout ratio sitting at 27% of the company’s earnings. Over the last five years, the payout has been boosted twice.

Up 40% year-to-date, MU shares have widely outperformed the general market.

Image Source: Zacks Investment Research

Carvana

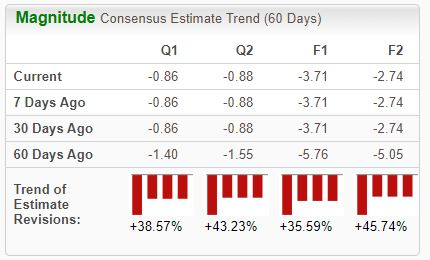

Carvana is a leading e-commerce platform for buying and selling used cars. The company has enjoyed positive earnings estimate revisions across the board, as we can see below. Wedbush upgraded CVNA shares to Neutral from Underperform, with a new $48 per share price target.

Image Source: Zacks Investment Research

The company has consistently posted results above expectations as of late, exceeding the Zacks Consensus EPS Estimate by an average of 25% across its last four releases. Just in its latest print, the company posted a 51% EPS beat and reported revenue 13% ahead of expectations.

First Solar

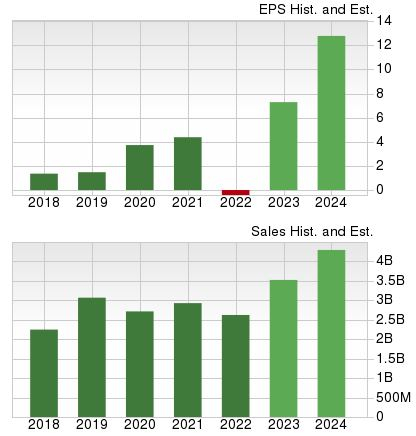

First Solar is a leading global provider of comprehensive PV solar energy solutions, specializing in designing, manufacturing, and selling solar electric power modules. BMO Capital upgraded FSLR shares to Outperform with a new $237 per share price target.

The company’s growth trajectory is impossible to ignore, with earnings forecasted to soar nearly 2,000% in its current year on 35% higher revenues. And the growth is slated to continue, with estimates alluding to a further 72% boost in earnings on a 30% sales bump in FY24.

Image Source: Zacks Investment Research

Bottom Line

Price targets can be helpful tools. Of course, it’s critical to note that not all stocks reach these forecasted levels, as unforeseen circumstances can always affect future performance.

Still, the positivity surrounding upgrades can be seen as a solid takeaway.

For those seeking stocks that analysts have recently received favorable coverage, all three above – Micron MU, Carvana CVNA, and First Solar FSLR – precisely fit the criteria.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.