The Q3 earnings cycle has officially begun, with several S&P 500 companies already revealing quarterly results. It’ll be another highly critical cycle, particularly as we continue to wade through a degree of uncertainty.

For a detailed analysis of Q3 earnings, I invite you to view our weekly Earnings Trends report -> The Q3 Earnings Season Kicks Off

As usual, there are likely to be many surprises throughout the period, which could include reports from Celsius Holdings CELH, NVIDIA NVDA, and Live Nation Entertainment LYV. All three have seen positive earnings estimate revisions for their upcoming quarters to be released, reflecting optimism among analysts.

Let’s take a closer look at each.

Celsius Holdings

Celsius has a strong earnings track record, exceeding the Zacks Consensus EPS Estimate by at least 80% across its last three quarters. In its latest print, the company posted a sizable 100% EPS beat and reported revenue 15% ahead of expectations.

The market has reacted strongly following back-to-back releases, as illustrated below. Still, the recent momentum has cooled, with shares giving up the majority of their post-earnings gains.

Image Source: Zacks Investment Research

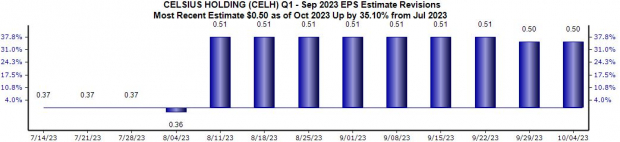

Analysts have been primarily bullish for the quarter to be reported, with the $0.50 Zacks Consensus EPS Estimate up more than 35% since July. Top line expectations have also moved higher, with the $344 million quarterly revenue estimate 13% higher over the same period.

As we can see below, analysts raised their expectations notably following its most recent release but have primarily kept them unchanged since.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

NVIDIA

NVIDIA shares have been the story of 2023, up 200% year-to-date on the back of optimism surrounding Wall Street’s shiny new toy, artificial intelligence (AI). The company’s earnings releases in 2023 have consistently resulted in fireworks post-earnings, as shown below.

Image Source: Zacks Investment Research

Regarding the latest release, NVDA’s earnings improved 430% year-over-year, whereas revenue jumped 100% from the same period last year. Data Center revenue, which consists of AI chips, grew 140% sequentially and 170% year-over-year, crushing expectations.

For the upcoming print, the Zacks Consensus Estimate for Data Center revenues sits at $12.6 billion, reflecting a sizable 230% improvement from the same period last year. It’s reasonable to assume that shares will see a strong reaction post-earnings despite their 200% YTD gain if the company continues to discuss scorching demand.

Analysts have rapidly revised their expectations for the upcoming release, with the $3.34 Zacks Consensus EPS Estimate up 50% since just July. Top line positivity is also apparent, as the $16.1 billion estimate has moved 35% higher during the same period.

Image Source: Zacks Investment Research

Live Nation Entertainment

LYV shares sold off post-earnings despite posting an 80% EPS beat and reporting revenue more than 15% ahead of expectations. Still, the adverse reaction in shares likely reflects a level of profit-taking after a strong run off their early May lows.

Image Source: Zacks Investment Research

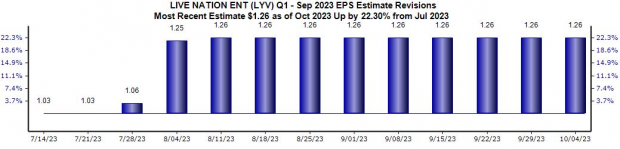

Still, analysts have shown positivity for the release, as the $1.26 Zacks Consensus EPS Estimate has moved 22% higher since July, with the quarterly revenue estimate up 8% in the same timeframe.

Image Source: Zacks Investment Research

There were several notable highlights from the latest release, including operating income climbing 21%, operating cash flow totaling $491 million, and revenue increasing 27% to $5.6 billion. Further, the company expects a record number of fans and Ticketmaster sales in 2023.

Bottom Line

Earnings season is always an exciting period for investors, with companies finally pulling the curtain back and unveiling what’s transpired behind the scenes.

As usual, there are surprises lurking underneath, a few of which could come from Celsius Holdings CELH, NVIDIA NVDA, and Live Nation Entertainment LYV. All three have posted robust results in 2023 and sport a favorable Zacks Rank, with the latter reflecting optimism among analysts.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.