Stock buybacks, also known as share repurchase programs, are commonly implemented by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock, essentially re-investing in itself.

There are several reasons companies elect to buy back their stock: companies have decided to utilize excess cash, want to limit dilution caused by employee stock option programs, or simply because they believe their shares are undervalued.

Three companies – NVIDIA NVDA, NVR NVR, and Ameriprise Financial AMP – have all recently unveiled repurchase programs. Let’s take a closer look at each.

NVIDIA

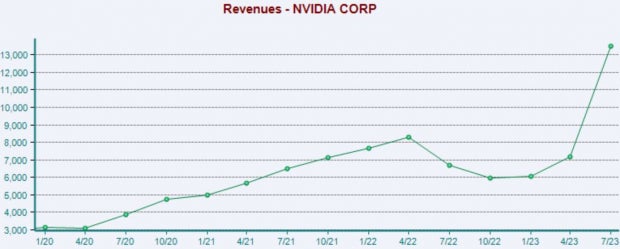

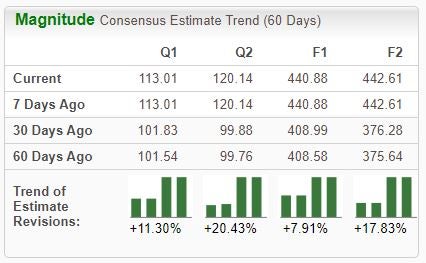

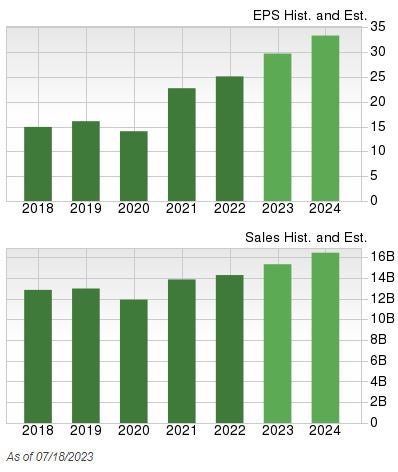

NVIDIA unveiled an additional sizable $25 billion share buyback following its latest blowout quarter, undoubtedly to the likes of investors. The stock is a Zacks Rank #1 (Strong Buy), with earnings estimate revisions hitting the tape across the board.

Image Source: Zacks Investment Research

Regarding the mentioned quarter, the company exceeded the Zacks Consensus EPS Estimate by nearly 30% and posted a 20% revenue beat.

Earnings improved 430% year-over-year, whereas revenue jumped 100% from the same period last year. Data Center revenue, which consists of AI chips, grew a remarkable 140% sequentially and 170% year-over-year, crushing expectations.

Image Source: Zacks Investment Research

NVR

Directors of NVR recently authorized a $500 million share buyback on August 2nd. Analysts have taken their earnings expectations higher across the board, helping land the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company has consistently exceeded quarterly estimates, sporting an average 10% EPS beat across its last four quarters. Just in its latest release, the company beat bottom line expectations by more than 15% but delivered a slight revenue miss.

Image Source: Zacks Investment Research

Ameriprise Financial

Ameriprise Financial authorized an additional $3.5 billion share repurchase program in late July. The stock is currently a Zacks Rank #3 (Hold).

The company’s growth profile is hard to ignore, further reflected by its Style Score of “B” for Growth. AMP’s earnings are forecasted to climb 20% in its current year on 10% higher revenues. Peeking ahead to FY24, expectations allude to a further 12% bump in earnings paired with 7% higher sales.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies boost shareholder value is through implementing share buybacks. In its simplest form, buybacks represent a company essentially re-investing in itself.

In addition, it can provide a nice confidence boost for investors, as the buybacks indicate that the company is utilizing its excess cash and not just hoarding it.

All three stocks above – NVIDIA NVDA, NVR NVR, and Ameriprise Financial AMP – have recently unveiled repurchase programs, attempting to maximize shareholder value.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand-picked 7 your immediate attention.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.