Earnings season has finally arrived, and investors are more than anxious for companies to finally pull the curtain back and unveil what has transpired behind the scenes.

An investor favorite, the EV titan Tesla TSLA, is on deck to unveil quarterly results on October 19th after the market close.

Over the years, the company has evolved much farther beyond EVs, transforming into a dynamic technology innovator.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How does everything shape up for the EV titan heading into the quarterly print? Let’s take a closer look.

Share Performance & Valuation

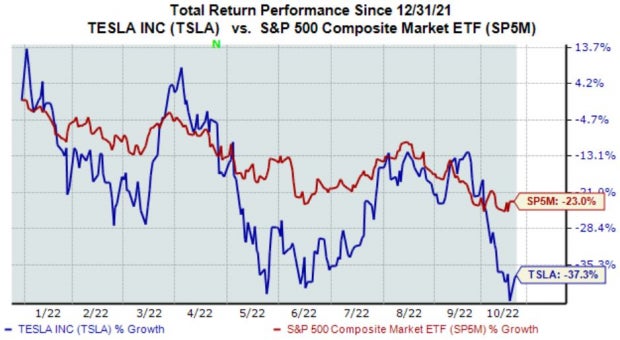

Year-to-date, TSLA shares have struggled to find their footing, down more than 37% and widely underperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, the story has remained the same; TSLA shares have declined 10%, lagging behind the S&P 500’s decline of nearly 7%.

Image Source: Zacks Investment Research

It’s no secret that TSLA shares are pricey, with the company’s 8.1X forward price-to-sales ratio representing a steep 198% premium relative to the S&P 500.

Still, the value is a fraction of 2021 highs of 23.9X, perhaps indicating that long-term investors could start getting interested.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have had mixed reactions to the quarter to be reported over the last several months, with five negative and five downwards earnings estimate revisions hitting the tape. Still, the Zacks Consensus EPS Estimate of $0.95 suggests a stellar 53% Y/Y uptick in earnings.

Image Source: Zacks Investment Research

The company’s top-line is also in exceptional health; the Zacks Consensus Sales Estimate of $22.3 billion reflects a 62% Y/Y uptick in quarterly revenue.

Quarterly Performance & Market Reactions

TSLA has a strong earnings track record, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in each of its last six reports. Just in its latest print, the EV titan penciled in a rock-solid 24.5% EPS beat.

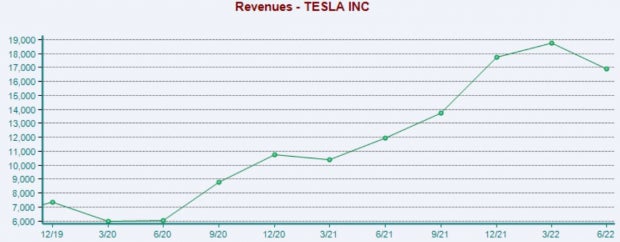

Revenue results have also been robust; TSLA has exceeded the Zacks Consensus Sales Estimate in nine of its last ten quarterly reports. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Expect shares to be volatile after the company’s quarterly print; TSLA shares moved upwards by nearly 11% following its latest earnings release.

Putting Everything Together

TSLA shares have struggled across multiple timeframes in 2022, telling us that sellers have been in control.

The company’s valuation levels are undoubtedly stretched, but that’s typical of high-growth stocks expected to grow at a breakneck pace.

Analysts have been mixed in their earnings outlook, but estimates reflect substantial upticks in both revenue and earnings.

Further, TSLA has consistently exceeded quarterly estimates, and by sizable percentages at that. Still, expect shares to be volatile following the release.

Heading into the release, Tesla TSLA carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of a marginal -0.03%.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.