Sibos has returned as an in-person event for 2022 – with more than 9,300 members of the financial community coming together either in Amsterdam or via its digital conference offering.

H.M. Queen Máxima of the Netherlands opened the annual conference, exhibition and networking event organised by Swift at Amsterdam’s RAI convention centre. She presented in her capacity as the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA), a role she has held since 2009.

Queen Máxima shared her insights on the role of the industry and policymakers in improving digital access to responsible and affordable financial services. She said “we have a chance today to move beyond doing no harm to actually doing good”, that “financially healthy customers are better customers” and “If we get this right, digital innovation holds tremendous promise for financial inclusion and financial health.”

This was followed by the opening plenary with SWIFT’s CEO, Javier Perez Tasso sharing his perspective on the last 12 months, the industry challenges ahead, and SWIFT’s role in addressing them.

“We have our fair share of challenges with the pandemic, geopolitics and new technologies all contributing to the increase in fragmentation of the global financial industry,” he said: “Our community, as the backbone in the financial industry, has always been a symbol of global cooperation, focussing on the opportunities that can bring us together and that’s why I believe that we’re perfectly placed to be part of the solution addressing this fragmentation.”

Heading into space

Meanwhile, the opening keynote of this year’s Swift Innotribe was delivered by Dutch astronaut André Kuipers.

He shared fascinating insights into his unique experiences in space and explained how his fellow astronauts commented: “This was more important than the moon. We went to the moon and we discovered the Earth.”

Next, the Innotribe Tribal Gathering, moderated by Leda Glyptis, chief client office at 10x Banking, heard visions for the future of money in 2040.

- Lisa Moyle, chief strategy officer at VC Innovations, said: “We need to have a shift away from ownership to access. You use what you need, when you need it.”

- Ulyana Shtybel, CEO at Quoroom, said: “Digital identities will be unified and we will see many metaverses connected between each other.”

- Louise Smith, chair, Innovate Finance, said: “The future of money is nothing to do with money at all. It’s about privacy, reputation, respect, fairness and doing the right thing.”

Sustainable focus

Later, Ravi Menon, managing director at the Monetary Authority of Singapore (MAS) gave his take on how we can transform cross-border payments and how fintech can create a more inclusive society and sustainable planet.

“Sustainable finance is a powerful enabler for the net zero transition that the world needs to make,” he commented.

While a panel including Julia Romhanyi, global head of securities services at UniCredit; Pierre Davoust, head of central securities depositories at Euronext; Olivier Grimonpont, product management, market liquidity at Euroclear and Javier Hernani, head securities services at SIX discussed what is preventing securities from settling instantly.

- Hernani: “If we want to settle things digitally, we need CBDCs. It would be ridiculous to settle in Bitcoin or Ethereum.”

- Davoust: “Time constraints are very difficult to manage in an environment where trade will be settled in T+1.”

- Romhanyi: “I believe current technology is still not there or those which are there are still not widely used… but if you look further I think instant settlement will happen.”

Starling’s Engine

In the afternoon, Anne Boden, founder & CEO of Starling Bank discussed how the challenger bank is keen to talk to the industry about Engine by Starling, its cloud native, SaaS banking platform.

“We are here at Sibos to talk to banks around the world about the Starling Engine proposition. Wherever you are in the world, or wherever you operate your business, you can have a piece of Starling too.

“I’m a technologist at heart and when I built Starling, I made a list of 17 things that was holding back the ability to deliver great service at a cost customers could afford. I said ‘we are going to build a platform that solves these 17 things’ and we’ve done it. So this is the next stage of our journey.”

In the ‘Fighting cybercrime in uncertain times’ panel, moderated by Ben Lindgreen, head of cyber resistance at Pay.UK, participants featured Bronwyn Boyle, CISO at Mambu, William Hoffman, CISO at Deutsche Bank, Tami Hudson, cybersecurity client officer at Wells Fargo and Nicolas Trimbour, head of fraud prevention & CDO cash management at BNP Paribas.

- Boyle: “In the UK there was a really great shift on cybersecurity, always collaborate, don’t compete.”

- Hoffman: “What we should be doing is being as open so that we’re sharing best practice. There will be internal processes and procedures, which we will have whether they’re fraud prevention or cyber or otherwise. But let’s shine a light on what we’re doing…”

- Hudson: “There is still a strong sense of a fear of retribution somehow that that can occur if a company suffers a cyber attack, and makes it very public. And it shouldn’t be because there’s a lot of information and positive things that can be gained through that threat intelligence and that transparency.”

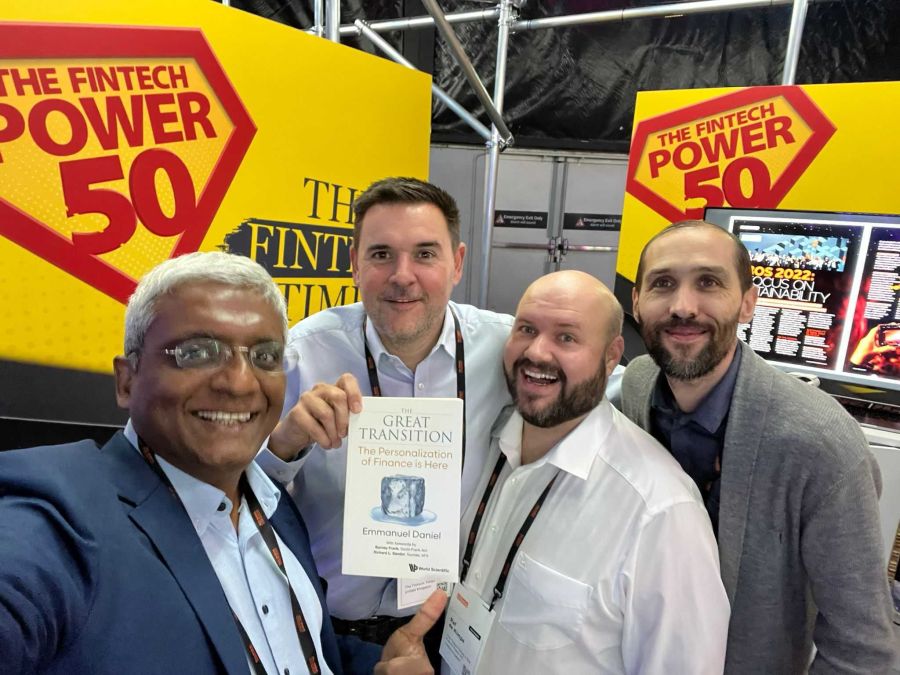

Book signing

Finally, award-winning writer and author Emmanuel Daniel, founder of The Asian Banker was at The Fintech Times and The Fintech Power 50 stand – DIS 05 – to sign his latest book The Great Transition: The Personalization of Finance Is Here.

If you missed Daniel, he’ll be back on Tuesday 11:00 to 12:00 then from 14:00 to 15:00; before joining us once more on 13 October from 11:00 to 12:00.

Image and article originally from thefintechtimes.com. Read the original article here.