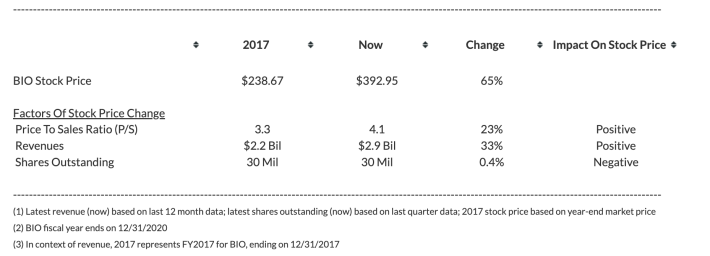

Bio-Rad Laboratories stock (NYSE: BIO), a life science research and clinical diagnostic products company, has seen a 48% fall this year, significantly underperforming the broader S&P500 index, down 24%. However, in the longer term, BIO stock, with 65% returns from levels seen in late 2017, has outperformed the S&P 500 index, up around 35%. After a sharp decline this year, BIO stock now looks undervalued, as discussed below.

This 65% rise for BIO stock since late 2017 can primarily be attributed to 1. Bio-Rad Laboratories’ revenue rising 33% to $2.9 billion over the last twelve months, compared to $2.2 billion in 2017, 2. a 23% rise in the company’s P/S ratio to 4.1x trailing revenues currently, compared to 3.3x in 2017, slightly offset by 3. a 0.4% rise in its total shares outstanding to 29.8 million. The increase in revenue and shares outstanding has meant that Bio-Rad’s revenue per share rose 32% to $96.36 over the last twelve months, vs. $72.80 in 2017. Our dashboard on Why Bio-Rad Laboratories Stock Moved has more details.

Bio-Rad’s revenue growth over the recent years can be attributed to higher sales of its Western Blotting, Digital PCR, and Process Media life science products. Some of the life science products were used for Covid-19 research and testing. Also, higher utilization in lab operations has aided the company’s clinical diagnostics sales. However, revenue for the first half of 2022 has seen a 3.6% fall due to forex headwinds and lower contribution from Covid-19-related sales, a trend expected to continue in the near term.

While Bio-Rad’s revenue growth has been steady, its operating margin has been very volatile, rising from 6.6% in 2017 to 185.4% in 2021 before falling to -91.4% for the last twelve months period. This can be attributed to changes in the fair market value of equity and debt securities significantly skewing its profits. Our Bio-Rad Laboratories Operating Income dashboard has more details.

Bio-Rad is reportedly in talks to merge with Qiagen – a German company that provides sample and assay technologies for molecular diagnostics, applied testing, and pharmaceutical research. Bio-Rad’s current market capitalization is around $12 billion, while Qiagen’s is at $10 billion. BIO stock declined 8% in yesterday’s trading session after the merger reports surfaced. Thermo Fisher Scientific (NYSE; TMO) made an unsuccessful attempt to acquire Qiagen for $10 billion in 2020.

Now, from a valuation point of view, BIO stock looks attractive. There are near-term headwinds, including forex and declining Covid-19-related demand, resulting in a low single-digit decline in 2022 sales to $2.8 billion (per the consensus estimates). Assuming the current share count of 29.8 million (reported for Q2 2022), we arrive at the expected revenue per share of $95.66 for the full year 2022. Now, at its current levels, BIO stock is trading at 4.1x forward expected revenues, compared to the last three-year average of 6.0x, implying that it is currently undervalued, and investors will likely be better off using the current dip for solid gains in the long term.

While BIO stock looks undervalued, it is helpful to see how Bio-Rad Laboratories’ Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

Furthermore, the Covid-19 crisis has created many pricing discontinuities, which can offer attractive trading opportunities. For example, you’ll be surprised at how counter-intuitive the stock valuation is for Corcept Therapeutics vs. Amerco.

What if you’re looking for a more balanced portfolio instead? Our high-quality portfolio and multi-strategy portfolio have beaten the market consistently since the end of 2016.

| Returns | Oct 2022 MTD [1] |

2022 YTD [1] |

2017-22 Total [2] |

| BIO Return | -6% | -48% | 116% |

| S&P 500 Return | 1% | -24% | 61% |

| Trefis Multi-Strategy Portfolio | 1% | -26% | 195% |

[1] Month-to-date and year-to-date as of 10/11/2022

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.