The legendary Warren Buffett, also known as the Oracle of Omaha, is a common name that comes to the front of many minds when thinking about the financial world.

Buffett is a philanthropist and businessman. He’s the CEO of Berkshire Hathaway (BRK.B), a diversified holding company whose subsidiaries engage in insurance, freight rail transportation, energy generation and distribution, manufacturing, and many others.

Throughout time, he’s reaped stellar returns in the market, making investors closely follow each of his moves.

And that’s what we’re here to look at today.

Three stocks that the Oracle of Omaha bought in 2022 include Occidental Petroleum OXY, McKesson Corp. MCK, and RH RH.

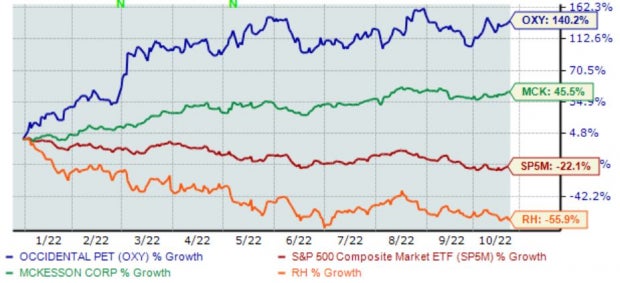

Below is a year-to-date chart illustrating the performance of all three stocks in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

Occidental Petroleum

Based in Texas, Occidental Petroleum is an integrated oil and gas company with significant exploration and production exposure. Buffett has been buying OXY stock aggressively, signaling a substantial bet on the energy sector.

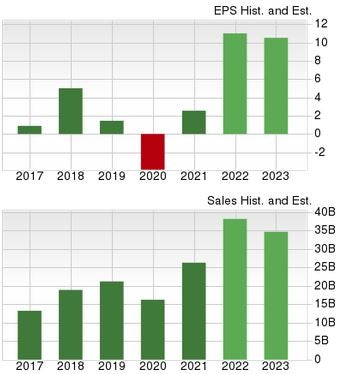

The company carries a loaded growth profile; earnings are forecasted to soar a triple-digit 320% in its current fiscal year, paired with forecasted revenue growth of nearly 50%.

The growth looks to slow down next year, as seen in the chart below.

Image Source: Zacks Investment Research

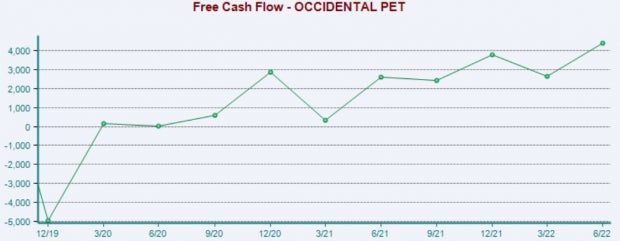

OXY’s been generating substantial cash – in its latest quarter, the company reported quarterly free cash flow of a steep $4.4 billion, penciling in a sizable double-digit 70% Y/Y uptick.

The company’s free cash flow has recovered nicely from 2019 lows, on a visible uptrend.

Image Source: Zacks Investment Research

McKesson Corp.

McKesson Corp. is a healthcare services and information technology company operating through two segments: Distribution Solutions and Technology Solutions.

MCK’s earnings outlook has turned bright over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

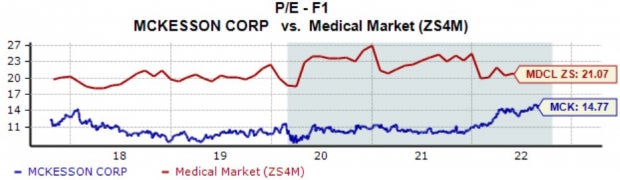

Shares currently trade at a 14.8X forward earnings multiple, above their five-year median. Still, the value represents a sizable 30% discount relative to its Zacks Medical sector.

Further, McKesson boasts a Style Score of an A for Value.

Image Source: Zacks Investment Research

The company also carries an impressive earnings track record, exceeding the Zacks Consensus EPS Estimate in all but one of its last ten quarterly reports. Just in its latest print, the medical giant penciled in a solid 10% earnings beat paired with a 5% revenue beat.

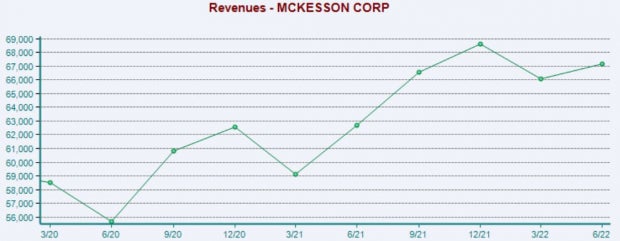

The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

RH

RH is a leading luxury retailer in the home furnishing space, offering dominant merchandise assortments across a growing number of categories, including furniture, lighting, textiles, bath-ware, décor, outdoor and garden, and tableware.

RH shares have become notably cheap amid the stretch of poor price action; the company’s 9.5X forward earnings multiple is nearly half its 18.3X five-year median, reflecting a steep 50% discount relative to its Zacks Consumer Staples sector.

Image Source: Zacks Investment Research

Like MCK, RH has an impressive earnings track record, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in back-to-back quarters.

Revenue results have also been strong, with the company exceeding top-line estimates in eight of its last ten prints.

Image Source: Zacks Investment Research

Bottom Line

Many people turn to Buffett when looking for stocks to add. After all, it’s easy to understand why after seeing his track record.

And in a historically-volatile 2022, he’s seen value in places, scooping up shares in Occidental Petroleum OXY, McKesson Corp. MCK, and RH RH.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

McKesson Corporation (MCK): Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

RH (RH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.