Shares of Seagen (SGEN) popped 14% yesterday on news that Pfizer (PFE) would acquire the company for $43 billion. The deal values Seagen shares at $229 and 15% above current levels.

Pfizer stock ended yesterday’s trading session up 1% with hopes that acquiring Seagen will give the company a boost as revenue from its Covid-19 vaccine begins to fade.

Let’s see if investors should consider Pfizer or Seagen stock following the acquisition announcement.

Brief Overview

The acquisition of Seagen would add to Pfizer’s product portfolio and sustainability in its drug pipeline. Specifically, Seagen would provide a boost to Pfizer’s Oncology segment through its antibody-drug conjugates (ADC) a form of cancer treatment that attacks cancer cells with toxins.

Pfizer anticipates that its revenue from ADCs will be around $10 billion by 2030. Seagen’s revenue last year was $1.96 billion although the company isn’t profitable yet and had a total loss of $610 million in 2022.

Image Source: Zacks Investment Research

Growth & Outlook

Piggybacking off the potential growth Pfizer would obtain through the acquisition, Seagen sales are projected to rise 19% this year and climb another 34% in FY24 to $3.14 billion. More impressive, fiscal 2024 would represent 133% growth from pre-pandemic levels with 2019 sales at $917 million.

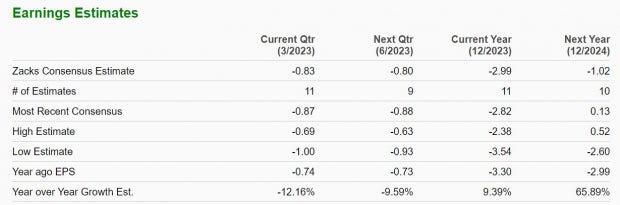

Seagen’s earnings are expected at -$2.99 per share in FY23 with EPS of -$1.02 forecasted in 2024 as the company moves closer to profitability. With that being said, earnings estimate revisions have gone down over the last 60 days.

Image Source: Zacks Investment Research

Pivoting to Pfizer, earnings are forecasted to drop -46% this year to $3.52 per share compared to EPS of $6.58 in 2022. Fiscal 2024 earnings are expected to rebound and rise 8% although earnings estimates have trended down significantly throughout the quarter.

Sales are projected to decline -32% in FY23 and then rise 1% in FY24 to $69.24 billion. Fiscal 2024 would still be a 33% increase from pre-pandemic sales of $51.75 billion in 2019.

Image Source: Zacks Investment Research

Recent Performance

Outside of shares of Seagen popping yesterday on the acquisition news, optimism surrounding the growth of the company’s ADC cancer treatment has continued to boost its stock in recent years. In contrast, Pfizer stock has continued to decline as we move further from the Covid-19 pandemic and the company sees less of a boost from its Comirnaty vaccine.

Seagen stock is up a stellar +55% year to date to easily top the S&P 500’s virtually flat performance and Pfizer’s -22%. Over the last three years, Seagen’s +107% has also topped the benchmark and Pfizer’s +32%.

Image Source: Zacks Investment Research

Takeaway

Pfizer stock currently lands a Zacks Rank #5 (Strong Sell) with Seagen landing a Zacks Rank #3 (Hold). Long-term, acquiring Seagen may be beneficial for Pfizer but there could be more short-term weakness ahead with earnings estimate revisions largely declining throughout the quarter and the acquisition could further dilute the company’s bottom line.

As for Seagen stock, its strong performance could continue with its acquisition price nicely above current levels of $199 per share despite earnings estimates declining as well. For now, investors may be rewarded for holding on to shares of SGEN as they could drift higher to the acquisition price of $229 per share.

Free Report: Must-See Hydrogen Stocks

Hydrogen fuel cells are already used to provide efficient, ultra-clean energy to buses, ships and even hospitals. This technology is on the verge of a massive breakthrough, one that could make hydrogen a major source of America’s power. It could even totally revolutionize the EV industry.

Zacks has released a special report revealing the 4 stocks experts believe will deliver the biggest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

Pfizer Inc. (PFE) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.