We’re in the thick of earnings season, with an extensive list of companies scheduled to unveil quarterly results in the coming weeks.

Southwest Airlines LUV is one of those, gearing up to unveil its quarterly results on July 27th before the market’s open.

But how does everything stack up for the company heading into the release? Let’s take a closer look using quarterly estimates and results from Delta Air Lines DAL as a small guide.

Delta Air Lines Q2

DAL’s results beat expectations thanks to continued strength in travel demand, registering a 10% EPS beat and delivering a positive 4% sales surprise. Earnings saw strong year-over-year growth, whereas quarterly revenue reflected a quarterly record.

The company’s top line has recovered nicely from the 2020 shock, with revenues now eclipsing pre-pandemic levels.

Image Source: Zacks Investment Research

Delta was firing on all cylinders throughout Q2; adjusted operating income of $2.5 billion reflected a quarterly record, with an operating margin of 17.1%. In addition, operating cash flow totaled $2.6 billion, whereas free cash flow reached $1.1 billion.

International demand was scorching hot, with international passenger revenue reaching a quarterly record and improving 66% year-over-year on the back of record profitability. And domestic demand also remained strong, with revenues growing 8% from the year-ago period.

As we can see from these results, the company had a record-breaking quarter. To top it off, the company raised its full-year EPS guidance to $6 – $7 and reiterated its previous cash flow guidance of $3 billion.

But how do expectations stack up for Southwest Airlines?

Southwest Airlines Expectations

Analysts have been optimistic regarding the upcoming release, with the $1.02 per share consensus estimate up a solid 6% just over the last several months. The value reflects a 17% pullback in earnings from the year-ago quarter.

Image Source: Zacks Investment Research

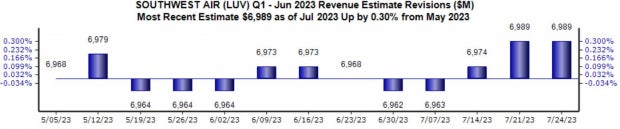

In addition, we expect the company to post $7.0 billion in quarterly revenue, suggesting an improvement of 4% year-over-year. Analysts have also shown modest positivity regarding the company’s top line, with the $7.0 billion estimate up 0.3% since the end of May.

Image Source: Zacks Investment Research

The company posted results under expectations in its latest release, falling short of the Zacks Consensus EPS Estimate by roughly 28% and reporting revenue modestly under expectations. Shares haven’t seen much buying activity following back-to-back releases, a development investors should be aware of.

Bottom Line

With earnings season in full swing, investors will remain busy with quarterly releases for some time.

And soon, on July 27th, after the market’s close, we’ll hear from Southwest Airlines LUV. A peer, Delta Air Lines DAL, reported better-than-expected results, reporting record quarterly revenue and raising its current year EPS guidance thanks to continued strength in travel demand.

Analysts have taken their expectations higher for the quarter to be reported over the last several months, with earnings forecasted to dip but revenue expected to see modest growth. Heading into the release, Southwest Airlines is a Zacks Rank #3 (Hold) with an Earnings ESP Score of +2.6%.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.