Large-cap technology has been hot in 2023, with buyers swarming following a brutal showing last year. The tech-heavy Nasdaq just etched in a 15% gain in Q1, reflecting the best performance since back in 2020.

However, not all are suited for the volatility many technology stocks come with, perhaps steering them away from the sector.

For those interested in limiting volatility but still seeking exposure to the sector, targeting dividend-paying technology stocks would provide precisely that.

Three technology stocks – Broadcom AVGO, Cisco Systems CSCO, and International Business Machines IBM – all reward their shareholders via dividends.

For those interested in reaping a passive income stream paired with exposure to technology, let’s take a closer look at each.

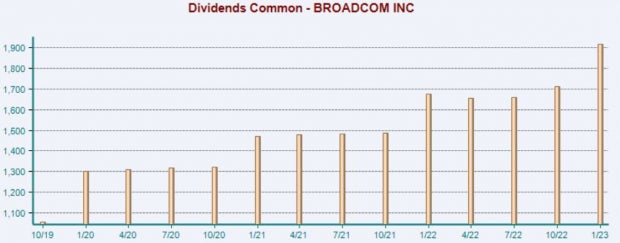

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. Presently, the stock sports a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company’s annual dividend currently yields a solid 2.9%, more than double the Zacks Computer and Technology sector average. Broadcom has shown a commitment to increasingly rewarding its shareholders, boasting a 20% five-year annualized dividend growth rate.

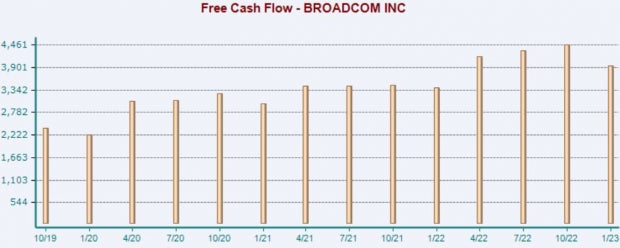

Image Source: Zacks Investment Research

And for the cherry on top, AVGO has generated strong cash as of late; Broadcom generated roughly $3.9 billion in free cash flow in its latest quarter, representing year-over-year growth of 16%.

Image Source: Zacks Investment Research

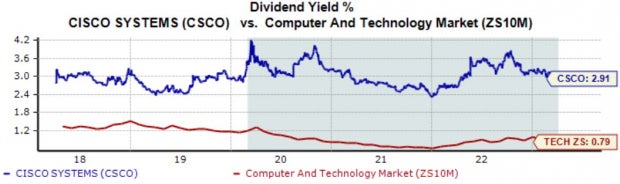

Cisco Systems

Cisco Systems is an IP-based networking company offering products and services to service providers, companies, commercial users, and individuals. Analysts have taken a bullish stance on the company’s earnings outlook, landing it into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Cisco’s annual dividend yield stands at 2.9%, again well above the Zacks Computer and Technology sector average. Further, the company’s 50% payout ratio sits on the sustainable side.

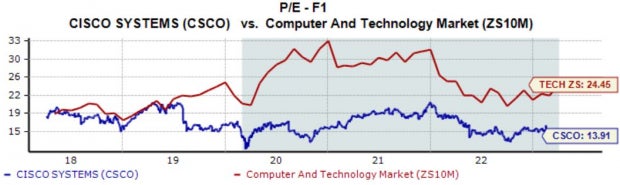

Image Source: Zacks Investment Research

In addition, CSCO shares aren’t expensive on a relative basis, with the current 13.9X forward earnings multiple sitting nicely beneath the 16.5X five-year median and the Zacks sector average.

Image Source: Zacks Investment Research

International Business Machines

International Business Machines has gradually evolved as a provider of cloud and data platforms, with its Red Hat acquisition strengthening its position in the hybrid cloud market. The company sports a Zacks Rank #2 (Buy).

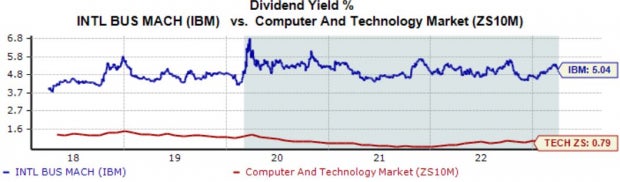

IBM’s annual dividend currently yields a steep 5%, crushing the Zacks sector average. Like AVGO, the company has shareholders’ interest at heart, increasing its payout six times over the last five years.

Image Source: Zacks Investment Research

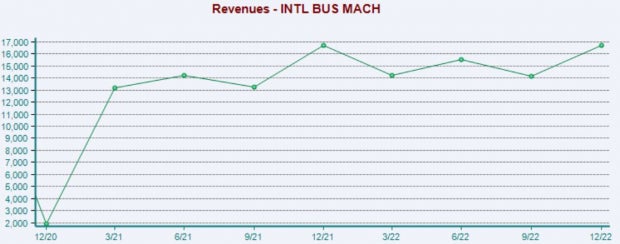

Keep an eye out for IBM’s upcoming quarterly release on April 18th; the Zacks Consensus EPS Estimate of $3.60 suggests a sizable 150% year-over-year uptick in earnings. Our consensus revenue estimate stands at $14.3 billion, implying growth of roughly 1% year-over-year.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Many investors love technology exposure and many love dividends.

Fortunately for those with an appetite for both, all three stocks above – Broadcom AVGO, Cisco Systems CSCO, and International Business Machines IBM – provide exposure to technology paired with dividends.

All three sport a favorable Zacks Rank, indicating favorable earnings estimate revisions from analysts.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.