There are many types of investing styles deployed within the market. Some investors prefer to target income, and some prefer value.

As many know, growth investing has made a comeback in 2023 amid the market’s rebound, with many high-flying names enjoying positive price action year-to-date.

And for those interested in the growth investing style, three stocks – Amazon AMZN, Asure Software ASUR, and Abercrombie & Fitch ANF – could all be considered.

On top of strong projected growth, all three sport a favorable Zacks Rank, indicating optimism among analysts. Let’s take a closer look at each.

Amazon

Amazon shares have helped lead the market’s surge in 2023, up roughly 50% and widely outperforming the S&P 500. Analysts have raised their earnings expectations across the board, helping land the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company is expected to witness a notable growth recovery following a harsh operating environment in 2022, with Zacks Consensus Estimates suggesting 214% EPS growth on 11% higher revenues in its current year (FY23). And the growth is slated to continue, with expectations alluding to a further 40% boost in earnings paired with a 13% revenue climb for FY24.

Asure Software

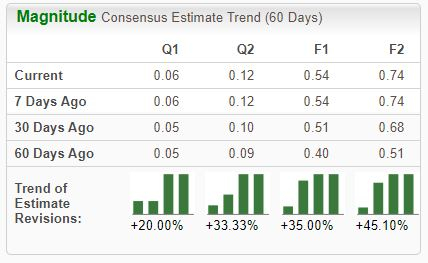

Asure Software, a current Zacks Rank #1 (Strong Buy), provides Web-based workforce management solutions. Analysts have raised their expectations across all timeframes.

Image Source: Zacks Investment Research

The company’s shares aren’t valuation stretched given its forecasted growth, with earnings suggested to climb 260% in its current fiscal year and an additional 37% in FY24. Shares presently trade at a 13.8X forward 12-month earnings multiple.

It’s worth noting that ASUR has been a consistent earnings performer, exceeding our consensus EPS and revenue estimates in each of its last four releases. In fact, the average beat across its last four releases is a sizable 670%.

Despite the better-than-expected results, shares have faced volatility post-earnings in back-to-back releases, setting up a sizable discount for potential buyers.

Image Source: Zacks Investment Research

Abercrombie & Fitch

Abercrombie & Fitch, a current Zacks Rank #1 (Strong Buy), operates as a specialty retailer of many types of premium, high-quality casual apparel for men, women, and kids through a vast store network. The company’s earnings are forecasted to jump 1600% in its current year, with an improved operating environment providing tailwinds.

The revisions trend has been particularly notable for its upcoming release expected in November, up 245% since July of this year.

Image Source: Zacks Investment Research

The company’s latest quarterly results came in nicely above expectations, causing shares to soar post-earnings. ANF’s inventory levels declined 30% year-over-year and posted an operating margin of 9.6%, with the latter nowhere near the year-ago figure of roughly breakeven. And to top it off, the company raised its full-year sales and operating margin outlook.

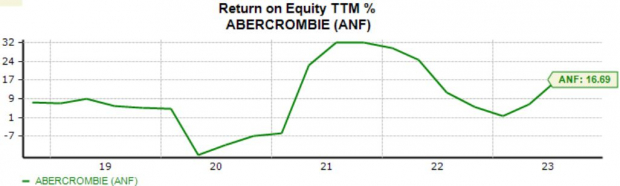

In addition, the company’s improving ROE is undoubtedly worth highlighting, reflecting higher efficiency in generating profits from existing assets.

Image Source: Zacks Investment Research

Bottom Line

Many growth stocks have jumped back into style in 2023 after last year’s rough showing, delivering market-beating returns.

And for those interested in this investing style, all three stocks above – Amazon AMZN, Asure Software ASUR, and Abercrombie & Fitch ANF – could be great considerations, all boasting improved earnings outlooks and solid growth profiles for their current fiscal years.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.