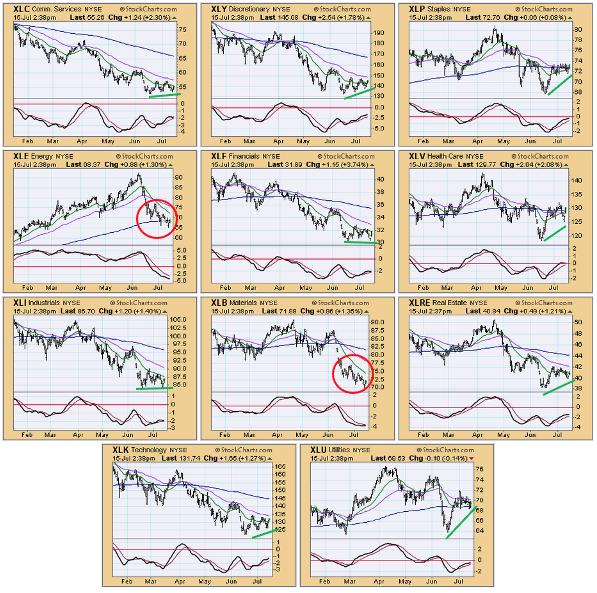

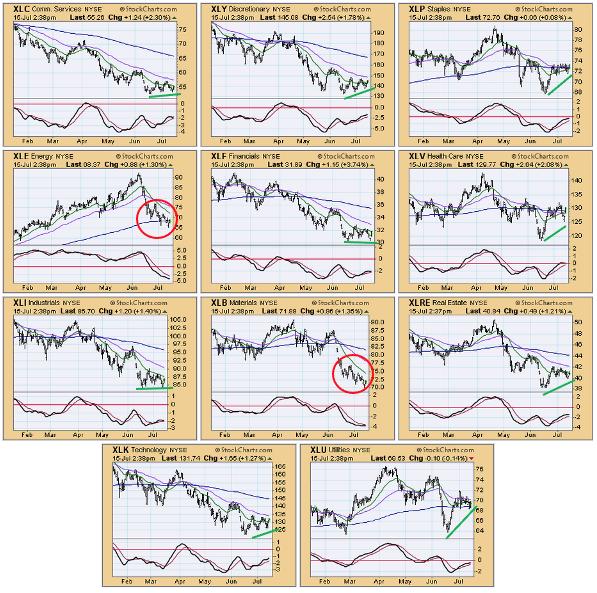

While we have negative long-term expectations for the market, we notice that most of the eleven S&P sectors are looking rather bullish intermediate-term. Only two sectors — Energy and Materials — have been making new lows, but the rest are either showing rising bottoms from the June low or are making a double bottom against that low.

In the Diamond Mine trading room, which Erin holds for subscribers of the DP Diamonds Report on Fridays at Noon ET, she “mines” to find the “Sector to Watch” and “Industry Group to Watch”. She noted that aggressive sectors were showing bullish price patterns, while defensive sectors (XLP, XLU and XLRE) were displaying fading strength. Here is an excerpt from Erin’s Diamonds Report today.

Our “Bear Market Special” Has Been Extended to July 22nd!

Get your first month of the “Bundle” for only $14!

Use Coupon Code: BEARS

Our subscriptions are priced to allow all investors access to professional grade analysis! Beginners to advanced, all can learn our analysis process!

- $35/month for our cornerstone DP Alert market letter with coverage of Gold, Gold Miners, Yields, the Dollar, Crude Oil, Bitcoin and MORE!

- $40/month for DecisionPoint Diamonds, ten+ handpicked stocks or “Diamonds in the Rough” AND a weekly subscriber-only Diamond Mine trading room!

$68/month for BOTH!

Click HERE to subscribe now!

In this morning’s Diamond Mine Trading Room, I liked XLY as a “Sector to Watch.” After getting participation data for the day, I still believe XLY is the most bullish. As far as “Industry Group to Watch,” I also haven’t changed my mind. Specialized Consumer Services is outperforming in a big way, and today’s rally suggests more upside ahead.

Sector to Watch: Consumer Discretionary (XLY)

I decided to go with XLY, but XLC and XLK were close seconds. My reasoning for this one over those was that we have better participation of stocks above their 50-day EMAs, and the SCI reading was higher than the others and rising steadily. We have a bullish ascending triangle, which implies a breakout above the confirmation line and 50-day EMA.

Industry Group to Watch: Specialized Consumer Services ($DJUSCS)

There were some interesting groups out there within XLY, but this chart floated to top. The RSI is positive, rising and not overbought. The PMO just accelerated above the zero line. Stochastics have tipped up. Not only is there an intermediate-term bullish double-bottom, but price is traveling in a rising trend channel.

Good Luck & Good Trading!

Erin Swenlin & Carl Swenlin

Don’t miss the new DecisionPoint Trading Room show! Carl has joined the room with Erin and answers questions from attendees or from comments left on YouTube. If you’d like to attend LIVE on Mondays, click HERE to register.

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.