Better than-expected CPI data for October and strong retail earnings have intensified this week’s stock market rally with The TJX Companies (TJX), Target (TGT), and Home Depot (HD) all posting favorable third quarter results.

With that being said, higher inflation has still curtailed consumer demand over the last year and investors may be wondering if it’s indeed time to buy stock in these retail heavy hitters.

The TJX Companies’ Q3 Review: Although TJX stock ended today’s trading session down -3% the off-price apparel and home fashion retail leader posted strong Q3 results on Wednesday beating top and bottom line expectations.

Third quarter earnings of $1.03 per share surpassed the Zacks Consensus of $0.97 a share by 6% with sales of $13.26 billion beating estimates by1%. Year over year, Q3 earnings jumped 20% with sales rising 9% from the prior year quarter.

Image Source: Zacks Investment Research

TJX shares are still up +12% in 2023 after today’s dip which may be attributed to some profit-taking and the company’s lower-than-expected guidance for Q4 EPS of $0.97-$1 per share compared to a previous target at $1-$1.03 a share. However, full-year EPS guidance of $3.61-$3.64 per share was up from $3.56-$3.62 a share after today’s earnings beat.

Plus, annual earnings estimates for TJX’s current fiscal 2024 and FY25 were already up in the last 30 days and are notably higher over the last three months landing TJX shares a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

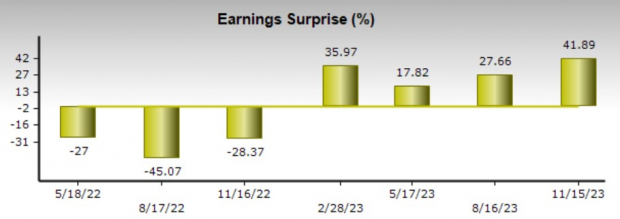

Target’s Q3 Review: Third-quarter results from Target this morning highlighted headlines as the omnichannel retailer crushed earnings expectations. With Target’s intriguing growth trajectory and outlook largely affected by higher inflation the company posted exhilarating Q3 earnings of $2.10 per share which topped the Zacks Consensus of $1.48 a share by 42%.

Target’s stock spiked roughly +18% on the earnings beat with Q3 sales of $25.39 billion slightly edging estimates of $25.24 billion. Third quarter earnings climbed 36% YoY although sales fell -4% from the comparative quarter. Inventory issues are starting to be controlled but Target stated higher shrink is still prevalent. Notably, TGT shares are still down -12% year to date.

Image Source: Zacks Investment Research

Optimistically, EPS estimates could start to go up after the impressive earnings beat but until then investors may want to fade the monstrous rally in TGT shares or stay on the sidelines as earnings estimate revisions are still noticeably lower over the last 90 days. In correlation with such, Target’s stock lands a Zacks Rank #4 (Sell) at the moment.

Image Source: Zacks Investment Research

Home Depot’s Q3 Review: Reporting its Q3 results on Tuesday, Home Depot’s stock has spiked 7% over the last two trading sessions and was up +1% today as the home improvement retailer also surpassed top and bottom line estimates.

Home Depot’s Q3 earnings of $3.81 per share beat expectations by 1% with sales of $37.71 billion slightly edging estimates of $37.52 billion. However, Home Depot’s Q3 earnings dropped -10% from $4.24 per share a year ago with sales dipping -3%.

Image Source: Zacks Investment Research

Home Depot stated inflationary pressures are mostly in the rear view mirror but HD shares are still down -2% for the year and currently land a Zacks Rank #4 (Sell) as earnings estimate revisions have trended down over the last 30 days for its current FY24 and FY25.

Image Source: Zacks Investment Research

Takeaway

Strong Q3 results from these retail leaders helped alleviate some of the clouds surrounding consumer spending. For now, the risk to reward is favorable for The TJX Companies’ stock when considering the trend of earnings estimate revisions and sound year over year quarterly growth while Target and Home Depot shares are less attractive in this regard.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Target Corporation (TGT) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.