The Zacks Medical sector has displayed relative strength and modestly outperformed the S&P 500 over the last three months, up more than 7% vs. the general market’s 4% gain.

For a quick and easy explanation, relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

Investors who target stocks displaying relative strength find themselves in favorable trends, no matter the direction of the general market.

Three dividend-paying stocks from the sector – Eli Lilly and Company LLY, AbbVie ABBV, and Pfizer PFE – could all be considerations for investors wanting to tap into the relative strength.

Below is a chart illustrating the performance of all three stocks over the last three months, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have outperformed the general market by wide margins over the last several months, indicating positive momentum. Let’s take a deeper dive into all three.

Eli Lilly and Company

Eli Lilly is one of the world’s largest pharmaceutical companies, boasting a diversified product profile that includes a solid lineup of new successful drugs.

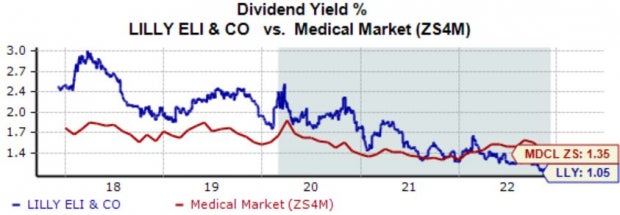

LLY’s annual dividend currently yields 1.1%, below that of its Zacks Medical sector average. Still, the company’s 14.6% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

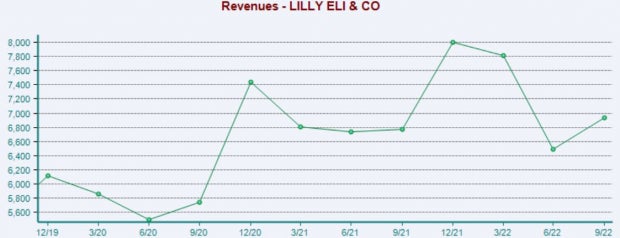

LLY has primarily posted better-than-expected earnings as of late, exceeding earnings and revenue estimates in two of its last three quarters. In its latest release, the company registered a slight 0.5% EPS beat paired with a 0.4% sales surprise.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

AbbVie

AbbVie is a global research-based biopharmaceutical company that delivers innovative medicines, becoming one of the top-most pharma companies after it acquired Botox maker Allergan in a cash-and-stock deal for $63 billion in May 2020.

Undoubtedly a major positive, AbbVie is a member of the elite Dividend King group. The company’s annual dividend currently yields an impressive 3.4% paired with a rock-solid 14% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

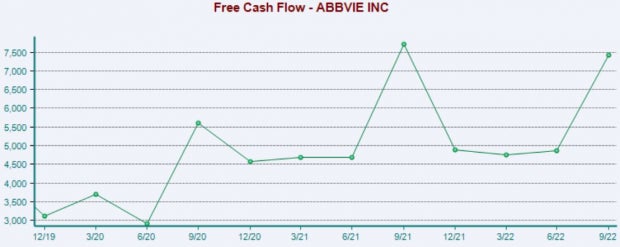

In addition, the company’s free cash flow growth is hard to ignore; in its latest release, AbbVie reported free cash flow of $7.4 billion, reflecting a 52% sequential increase.

Image Source: Zacks Investment Research

Pfizer

Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine.

PFE’s dividend metrics would please any income-focused investor; the company’s annual dividend currently yields 3.1% paired with a 4.5% five-year annualized dividend growth rate.

Further, the company’s 25% payout ratio is very sustainable.

Image Source: Zacks Investment Research

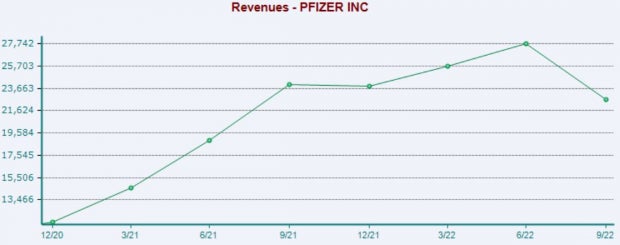

PFE has also posted strong quarterly results as of late, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in back-to-back releases. Just in its latest print, the pharmaceutical titan penciled in a 21% EPS beat paired with a 7.6% sales surprise.

Image Source: Zacks Investment Research

Bottom Line

Targeting stocks displaying relative strength is an excellent way for investors to ride favorable trends.

And over the last three months, all three stocks above – Eli Lilly LLY, AbbVie ABBV, and Pfizer PFE – have all outperformed the general market, displaying inspiring relative strength.

And for the cherry on top, all three companies pay out dividends, limiting drawdowns in other positions and providing a passive income stream.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Pfizer Inc. (PFE) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.