JHVEPhoto/iStock Editorial via Getty Images

Reinsurance Group of America (RGA) is trading ~9% higher after the insurer reported a non-GAAP EPS consensus beat in Q2 on favorable mortality experience.

The reinsurer’s Q2 non-GAAP EPS of $5.78 beats by $3.00, while revenue of $3.89B (-6.0% Y/Y) misses by $140M.

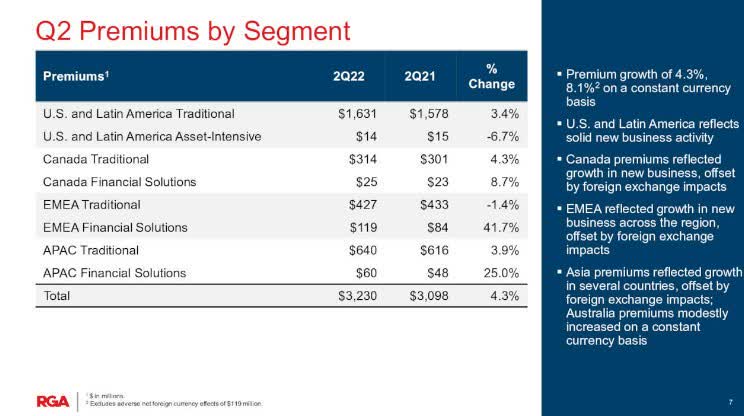

Net premiums stood at $3.23B, up 4.3% from the year-ago $3.10B.

“COVID-19 claim costs came down substantially this quarter, and our underlying non-COVID-19 mortality was favorable in many markets,” CEO Anna Manning said.

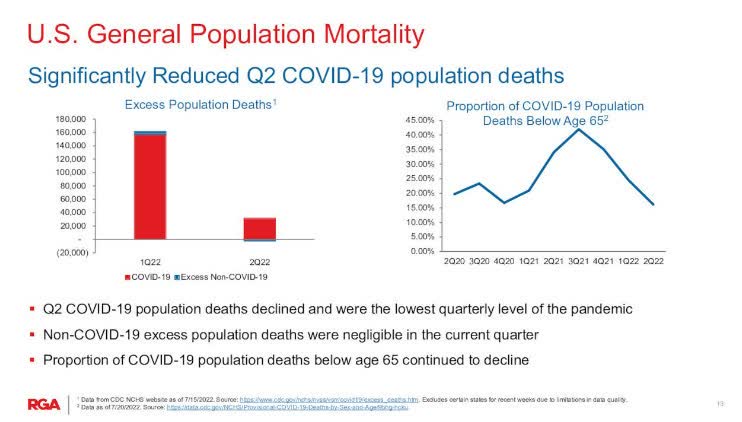

Here is a look at the Q2 U.S. general population mortality scenario:

Non-COVID-19 experience was favorable in the U.S., due to both lower frequency and lower average claim size. Meanwhile, COVID-19 claim costs were a net positive of $9M for teh company, according to its Q2 report.

The company saw strong earnings from the U.S., Asia and its global financial solutions unit.

Here is a look at the Q2 premiums by segment:

In June, Credit Suisse Analyst Andrew Kligerman had upgraded RGA to Neutral from Underperform on the basis of better COVID-19 conditions, as well as improving mortality trends.

Also, RGA was in the UBS top conviction picks for the financials and real estate sector.

Image and article originally from seekingalpha.com. Read the original article here.